|

|

|

|

|

|

|

|

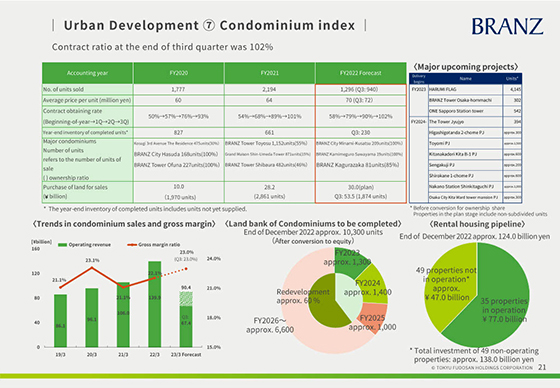

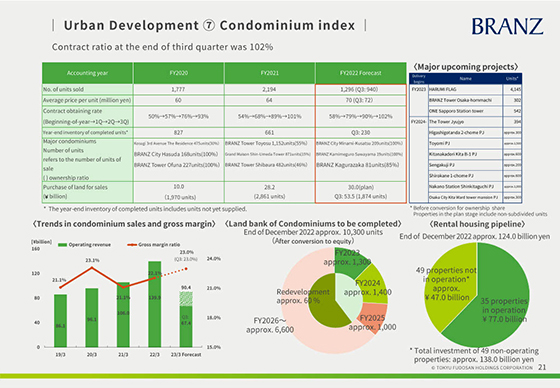

These are movements in business indicators for condominiums.

For the fiscal year ending March 31, 2023, the number of units sold of condominiums is expected to be 1,296 units, with operating revenue of 90.4 billion yen and gross margin of 23.0%.

Guaranteed agreements as a percentage of sales for the fiscal year ending March 31, 2023 rose to 102% as of December 31, 2022. Completed inventory stood at 661 units at the beginning of the fiscal year, but decreased to 230 units as of December 31, indicative of continuing strong sales of condominiums.

Regarding the acquisition of condominium lots, we made progress on investments, particularly for properties in central Tokyo, spending an additional 53.5 billion yen on land, equivalent to 1,874 units, and bringing our total land bank of condominiums expected to be recorded from next fiscal year onward to approximately 10,300 units.

The proportion of redevelopment properties in our land bank also reached approximately 60%.

As shown in the upper right-hand corner, we have a number of large properties, mainly redevelopment projects, in the pipeline as major projects going forward.

We will continue to strengthen our business with a particular focus on redevelopment of high value-added properties.

|

|

|