|

|

|

|

|

|

|

|

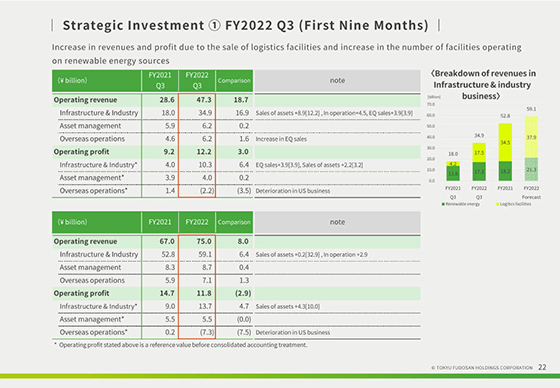

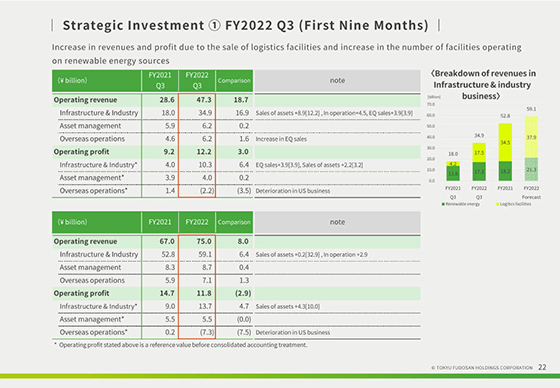

We will discuss our Strategic Investment segment.

In the third quarter, operating revenue came to 47.3 billion yen and operating profit to 12.2 billion yen, representing increases in both revenues and profit over the same quarter last fiscal year.

Our Infrastructure & Industry business experienced an increase in profit largely due to the sale of logistics facilities and the sale of equity, as well as an increase in the number of renewable energy facilities operating.

In the overseas business, profit decreased, owing largely to increased expenses, including the impact of foreign exchange and rising interest rates.

For our full-year forecast, we forecast operating revenue of 75.0 billion yen and operating profit of 11.8 billion yen, representing an increase in revenues and a decrease in profit over the previous fiscal year.

Operating profit for the third quarter exceeded our full-year forecast, but we expect a decrease in profit owing to factors such as the fall out of one-time profits in overseas operations and increased expenses, including the impact of foreign exchange and rising interest rates.

|

|

|