|

|

|

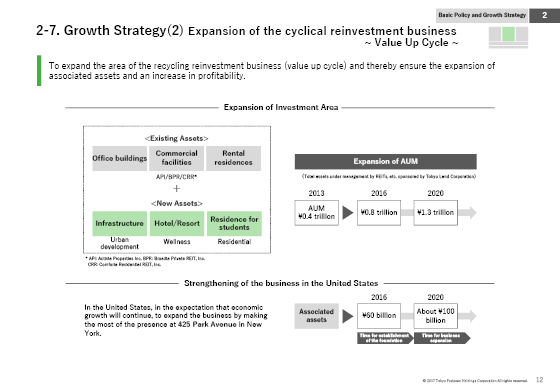

We will now look at our second growth strategy, which is the expansion of the coverage of the cyclical reinvestment business.

In the past, assets subject to recycling reinvestment were confined to offices, commercial facilities and leased residential buildings. Now the scope of cyclical reinvestment business will be enlarged to include new assets, such as the infrastructure, hotels and residences for students, in a bid to bolster our earning capacity.

Regarding the associated assets in our Group’s asset management business, we will expand the value of assets under management (AUM) in this business that stood at around 0.8 trillion yen in FY2016. It will be increased to 1.3 trillion yen in FY2020.

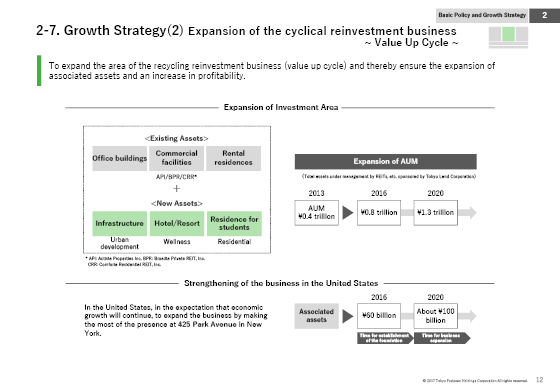

In the United States, the economy is expected to grow steadily in the future.

There, we will capitalize on our presence based on our implementation of the New York 425 Park Avenue Project in order to promptly establish business foundations and expand this business.

|

|

|