|

|

|

|

|

|

|

|

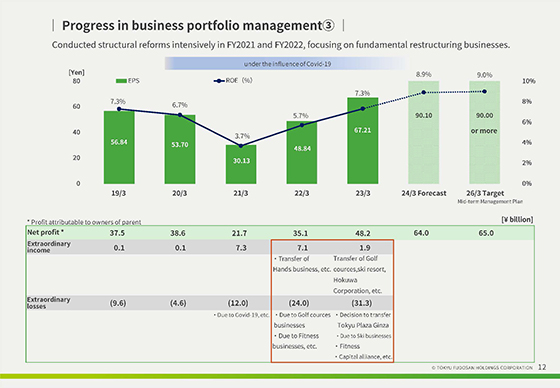

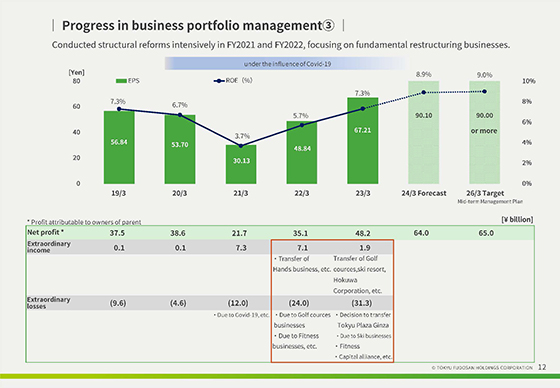

This section summarizes the structural reforms implemented in the fiscal years ending March 31, 2022 and 2023.

We intensively reviewed our business and asset portfolios, focusing on businesses that required fundamental restructuring.

A series of structural reforms, including the transfer of Tokyu Hands in the fiscal year ending March 31, 2022 and the decision to transfer Tokyu Plaza Ginza in the fiscal year ending March 31, 2023, and other business structural reforms that required balance sheet surgery with so-called major pain and loss, were completed by the fiscal year ending March 31, 2023. The company plans net profit of 64.0 billion yen, EPS of 90.10 yen, and ROE of 8.9% for the fiscal year ending March 31, 2024, based on upward revisions.

Although ROE temporarily declined to 3.7% in the fiscal year ended March 31, 2021 due to the impact of the COVID-19, it has been steadily recovering.

We will continue to promote EPS growth and ROE improvement by promoting business portfolio management with a primary focus on improving efficiency.

|

|

|