|

|

|

|

|

|

|

|

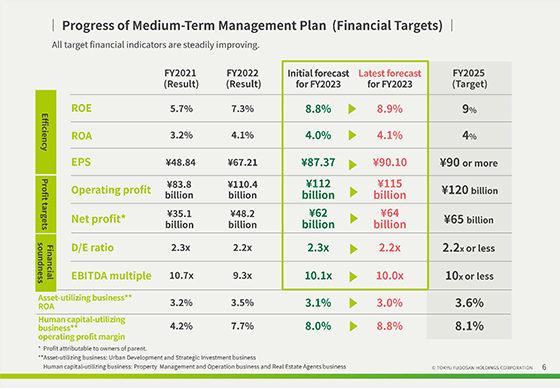

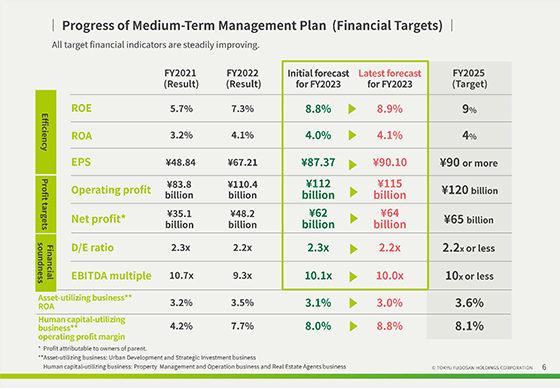

Regarding the revised forecast for the fiscal year ending March 31, 2024, although the uncertain business environment will continue, operating profit and profit attributable to owners of the parent company are expected to exceed the initial forecast due to the continuation of a strong real estate trading market and recovery in the hotel business.

ROE has improved to 7.3% in the fiscal year ending March 31, 2023, and will improve further to 8.9% in the fiscal year ending March 31, 2024, approaching the target level of the medium-term management plan in all indicators.

Since the time the medium-term management plan was formulated, performance figures have been better than expected, mainly due to the strong real estate trading market and a fast-paced recovery in inbound demand.

Although there are some business environments to watch closely, such as interest rate trends, we aim to achieve the target indicators for the fiscal year ending March 31, 2025, one year ahead of the target for the fiscal year ending March 31, 2026.

|

|

|