|

|

|

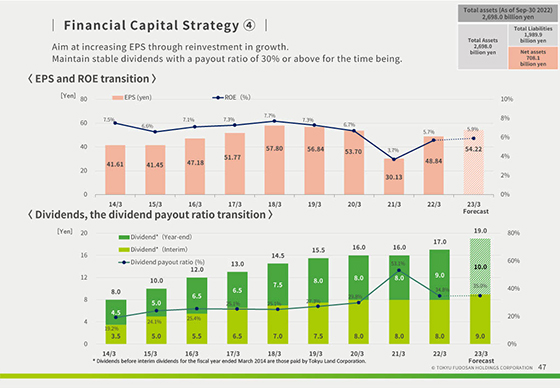

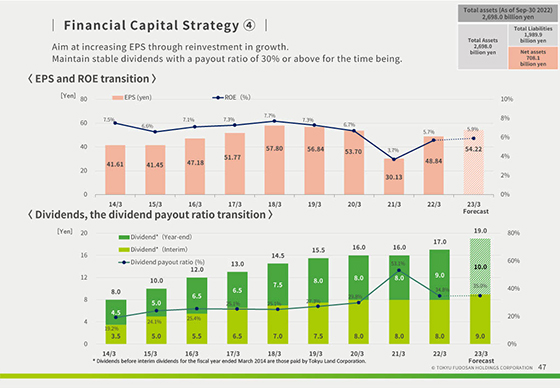

This is about ROE and shareholder returns.

For the fiscal year ended March 31, 2022, our ROE improved to 5.7% from the previous fiscal year, which was affected by the COVID-19 pandemic.

For the fiscal year ending March 31 2023, our target ROE is 5.9%.

We will aim to achieve a target ROE of 8% at an early stage, bearing in mind the cost of shareholders’ equity, and an ROE of 9% set for the fiscal year ending March 31, 2026 as a target of the medium-term management plan.

Moreover, we are planning to maintain a dividend payout ratio of 30% or higher and stable dividends as our immediate-term policy to return profits to our shareholders.

For the fiscal year ending March 31, 2023, we plan to pay a dividend of 19.0 yen, an increase of 2.0 yen year on year, with a payout ratio of 35.0%.

|

|

|