|

|

|

|

|

|

|

|

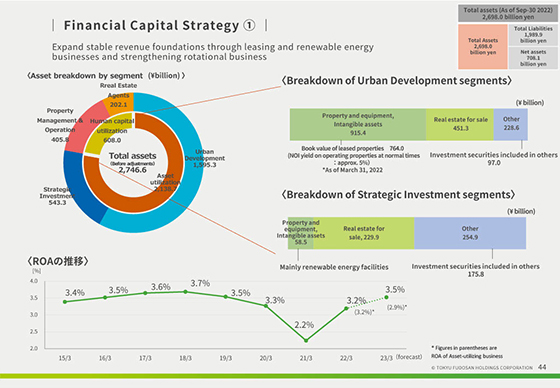

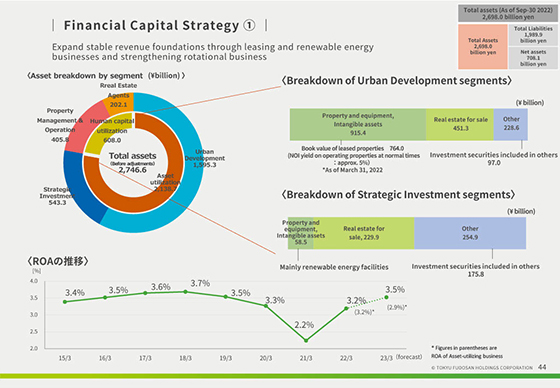

First, this is about assets.

The circle graph on the upper-left indicates assets classified by segment as of September 30, 2022.

Our Urban Development business segment accounted for 1,595.3 billion yen, and Strategic Investment segment accounted for 543.3 billion yen, with the asset utilizating-type business accounting for 78% of all assets.

Moreover, a breakdown of total assets in those two segments is indicated on the right side.

For the Urban Development segment, non-current assets include rental office and commercial facilities and other assets include investment securities, etc.

Among non-current assets, the book value of leased properties is 764.0 billion yen as of March 31, 2022. Our NOI yield is approx. 5%.

For the Strategic Investment segment, non-current assets include renewable energy facilities, etc. and other assets include investment securities, etc.

The lower column shows movements in ROA.

It was 3.2% for FY2021 ended in March 2022 and is expected to be 3.5% for FY2022 ending in March 2023. We are aiming to achieve an ROA of 4% for FY2025 as a KPI of the medium-term management plan.

In the asset-utilizing business in particular, we intend to improve ROA by bringing large properties into operation, expanding high-efficiency businesses such as renewable energy, strengthening circular business, etc. The ROA target for the asset utilization-type business is 3.6% for the fiscal year ending March 31, 2026.

|

|

|