|

|

|

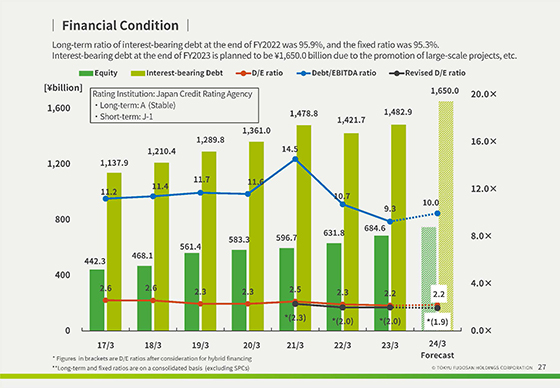

This section discusses changes in interest-bearing debt and other factors.

The long-term ratio of interest-bearing debt as of March 31, 2023 was 95.9%, and the fixed ratio was 95.3%, indicating that stable financing is continuing.

The long-term ratio of interest-bearing liabilities as of March 31, 2023 is 95.9%, and the ratio of fixed liabilities is 95.3%, indicating that the Company continues to procure stable funds.

We plan to have a debt-to-equity ratio of 2.2 times, and a debt-to-equity ratio of 1.9 times after taking hybrid financing into account, totaling 1.65 trillion yen.

We will continue to control BS with an awareness of maintaining and improving financial soundness.

JCR’s long-term issuer rating has remained unchanged and A flat even under the Covid-19 pandemic since the rating was upgraded in January 2019.

|

|

|