|

|

|

|

|

|

|

|

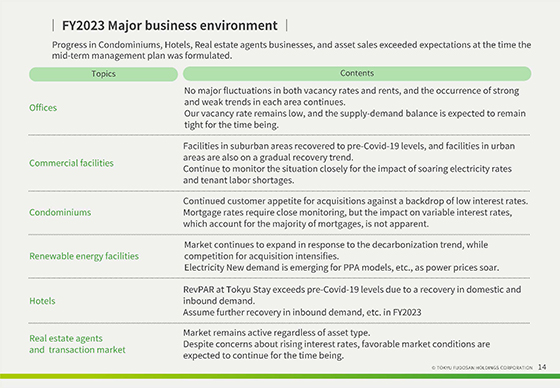

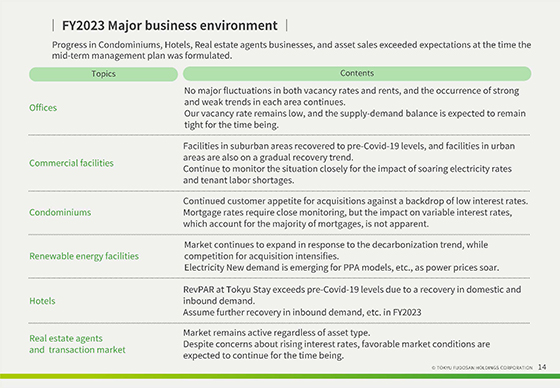

This section discusses the environmental perceptions of our major businesses.

There have been no major changes since the announcement of financial results in May.

In the office market, there have been no major fluctuations in both vacancy rates and rents, and although each area has its own favorable and unfavorable conditions, the Shibuya area, which is the Company's core area, continues to be favorable due to the characteristics of many growing companies, and the Company's vacancy rate remains at a low level.

The tight supply-demand balance is expected to continue for the time being, especially in the Shibuya area.

In commercial facilities, sales at suburban facilities are exceeding before the Covid-19 pandemic, and sales at urban facilities are also recovering, including inbound sales.

On the other hand, the impact of soaring electricity prices and tenant labor shortages will continue to be closely monitored.

In the condominium market, customers continue to be eager to acquire condominiums against the backdrop of low interest rates and other factors.

Although the trend of mortgage rates requires close monitoring, variable interest rates, which are currently used by the majority of customers, have not risen, and sales continue to be strong.

In the renewable energy business, while the market continues to expand in response to the trend toward decarbonization, competition to acquire new projects is intensifying.

In addition, new demand such as PPA is emerging as the need for renewable energy-derived electricity rises.

In the hotel business, RevPAR of Tokyu Stay exceeded before the Covid-19 pandemic level due to the recovery of domestic and inbound demand.

In the fiscal year ending March 31, 2024, we expect to capture further inbound demand, etc.

In the real estate agents and transaction market, the transaction market continues to be active regardless of asset types. Although there are concerns about rising interest rates and other factors, the market environment is expected to remain favorable for the time being.

Condominiums, hotels, real estate agents, and asset sales are progressing better than expected at the time the medium-term management plan was formulated.

|

|

|