|

|

|

|

|

|

|

|

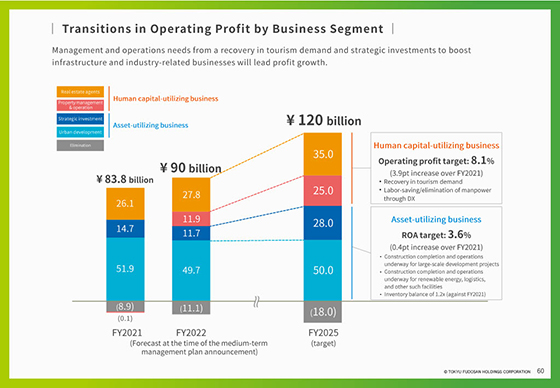

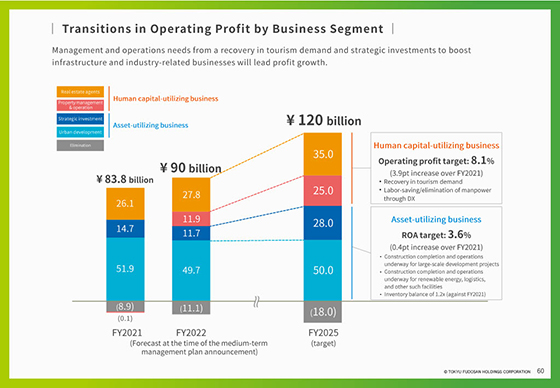

This shows transitions in operating profit by business segment.

In the Urban Development segment, we are promoting portfolio replacement, quality enhancement, etc., while maintaining the scale of our assets.

In the Strategic Investment segment, we plan to double profits through the operation of renewable energy, logistics facilities, etc.

In the Property Management & Operation segment, we expect a recovery in tourism demand, including inbound demand, in the second half of the plan.

In the Real Estate Agents segment, we expect growth to continue, driven by good market conditions.

Additionally, as a KPI for improving efficiency, we have set a target for ROA in the asset-utilizing business of 3.6%.

We plan to achieve this target by bringing large properties into operation, expanding high-efficiency businesses such as renewable energy, and strengthening circular business.

In the human capital-utilizing business, we plan to achieve an operating profit margin of 8.1%, supported by a recovery in tourism demand.

|

|

|