|

|

|

|

|

|

|

|

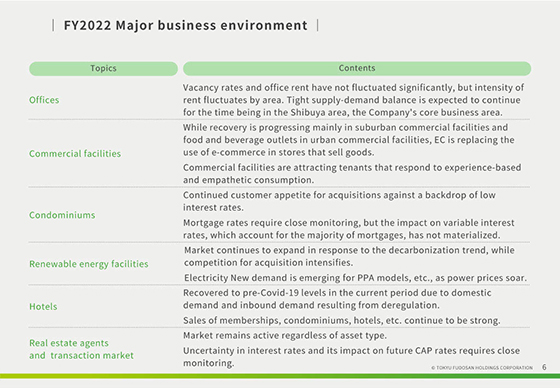

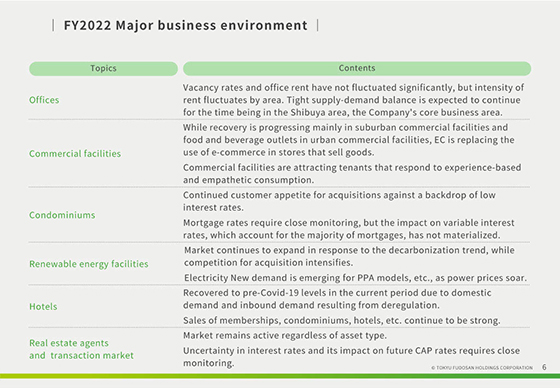

Let’s take a look at the recognition of business environment for our main businesses.

While no major effect on the vacancy rate and rent has been observed in the Company’s office building business, our performance alternates between favorable and unfavorable depending on the area.

In our mainstay area, Shibuya, good performance has continued, partly thanks to the characteristic of the area that there are many growth companies located there, and a tight supply-demand balance is expected to continue for the time being.

In regard to commercial facilities, recovery is proceeding, particularly at suburban facilities and restaurants in the center of Tokyo, while stores that sell goods are continuing to feel the impact of the shift to e-commerce.

The Company is focusing particularly on attracting tenants who cater to the needs for experience-based or empathy-based consumption.

In the condominium market, customers continue to have an appetite for acquisition, owing partly to low interest rates.

We must continue to pay close attention to interest rates on residential loans, but at present, there has not been any particular negative impact on the variable interest rates that are used by most customers.

In the Renewable Energy Business, while the market is continuing to expand amid the trend toward decarbonization, competition to acquire new projects is intensifying.

Additionally, as prices of electric power have risen recently, new demand for PPA models, etc., has become more notable.

In the Hotel business, RevPAR has recently recovered to pre-COVID-19 levels, thanks to domestic demand and inbound demand generated by the easing of regulations.

Sales of memberships, condominium hotels, etc., have also been strong.

Regarding real estate agents business and the market for transactions, the transaction market remains brisk, regardless of the type of asset.

Furthermore, we must pay close attention to any future impact on CAP rates as the outlook for trends in interest rates remains unclear.

|

|

|