|

|

|

|

|

|

|

|

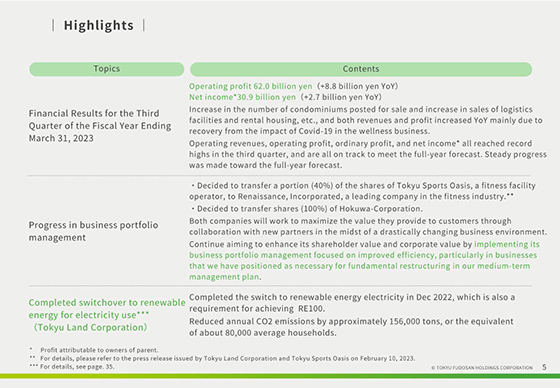

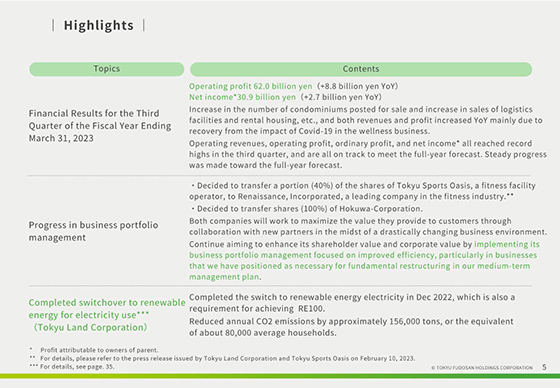

Please allow us to present financial highlights.

In the third quarter, operating profit came to 62.0 billion yen and profit attributable to owners of parent came to 30.9 billion yen.

The main reasons for the year-on-year increase in profit include an increase in the number of condominium units sold, an increase in sales of logistics facilities, rental housing, etc., and the good performance of the Wellness business.

We achieved our highest ever operating revenue, operating profit, ordinary profit, and profit attributable to owners of parent for the third quarter and are making steady progress toward our full-year earnings forecasts.

Moving on, this shows our progress on business portfolio management.

First, today, February 10, we decided to transfer 40% of the shares in a new company (that will inherit the trade name of Tokyu Sports Oasis), which will succeed to the operation of fitness centers and other businesses from Tokyu Sports Oasis via company split, to industry leader Renaissance incorporated. Furthermore, even after this transfer of shares, there will be no change to Tokyu Sports Oasis’ status as a consolidated subsidiary of the Company.

Additionally, on January 24, we decided to transfer all shares in Hokuwa Corporation, a subsidiary of NATIONAL STUDENTS INFORMATION CENTER, to YAHAGI CONSTRUCTION CO., LTD.

The effective transfer date of both actions is scheduled for March 31, 2023.

For both companies, our objective is to maximize the provision of value to customers through collaboration with new partners in the same industry, amid major changes in the business environment as a result of the COVID-19 pandemic and other factors.

The Company will continue aiming to enhance its shareholder value and corporate value by implementing its business portfolio management focused on improved efficiency, particularly in businesses that we have positioned as necessary for fundamental restructuring in our medium-term management plan.

Finally, this is about the completion of Tokyu Land’s switching of all electric power used at its offices and facilities that it owns to power generated from renewable energy.

In December 2022, we completed this switch, which is also one of the conditions for achieving RE100.

As a result of this switch, we will be able to reduce our CO2 emissions by approximately 156,000 tons per year, equivalent to the emissions of approximately 80,000 general households.

Details are explained on page 35.

|

|

|