|

|

|

|

|

|

|

|

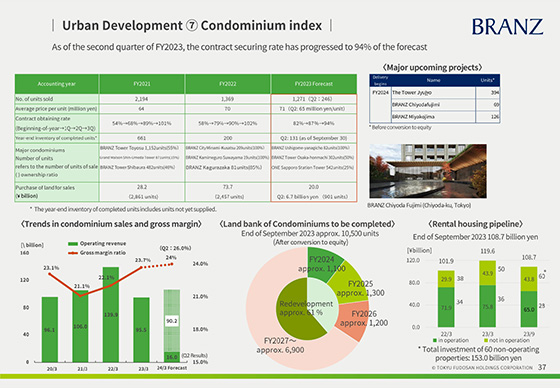

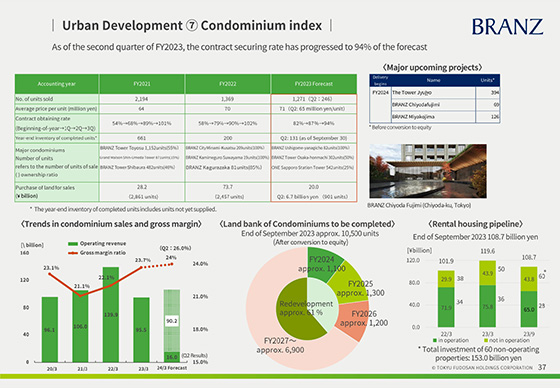

The following are operating indicators for condominiums for sale.

For the fiscal year ending March 31, 2024, we plan to post 1,271 condominiums for sale, sales of 90.2 billion yen, and a gross profit margin of 24%.

Sales of condominiums continue to be strong, with the contract obtaining rate for the fiscal year ending March 31, 2024 at 94% as of the end of September.

The inventory of completed units, which was 200 units at the beginning of the fiscal year ending March 31, 2024, stood at 131 units as of the end of September due to progress in sales.

The gross profit margin for condominiums for sale in the second quarter was 26.0% due to the recording of high-profit margin properties such as BRANZ Tower Shibaura.

Regarding the acquisition of land for condominiums, we secured 6.7 billion yen for land and 901 units on a unit basis through the acquisition of large-scale redevelopment projects, making steady progress toward our full-year plan of 20 billion yen.

The land bank to be recorded in and after the fiscal year ending March 31, 2025 is approximately 10,500 units, of which redevelopment properties account for approximately 61%.

|

|

|