|

|

|

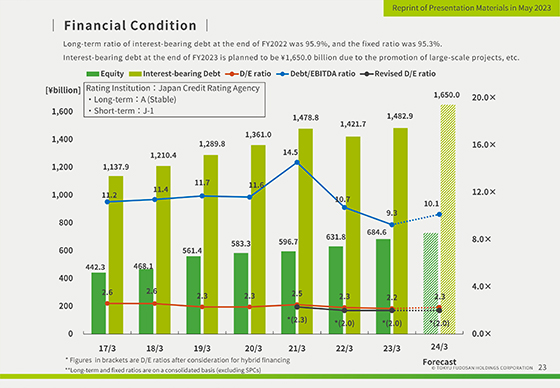

This section discusses changes in interest-bearing debt and other factors.

The long-term ratio of interest-bearing debt as of March 31, 2023 was 95.9%, and the fixed ratio was 95.3%, indicating that stable financing is continuing.

In addition, interest-bearing debt as of March 31, 2024, due to the promotion of large-scale projects, etc.,

we plan to have a debt-to-equity ratio of 1,650.0 billion yen and a debt-to-equity ratio of 2.3 times, and a debt-to-equity ratio of 2.0 times after taking hybrid financing into account.

We will continue to control BS with an awareness of maintaining and improving financial soundness.

JCR's long-term issuer rating has remained unchanged and A flat for Covid Disaster since the rating was upgraded in January 2019.

|

|

|