|

|

|

|

|

|

|

|

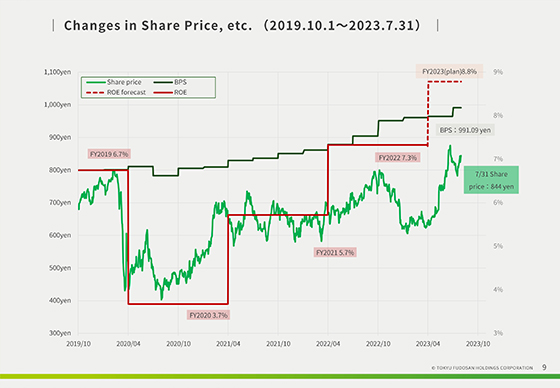

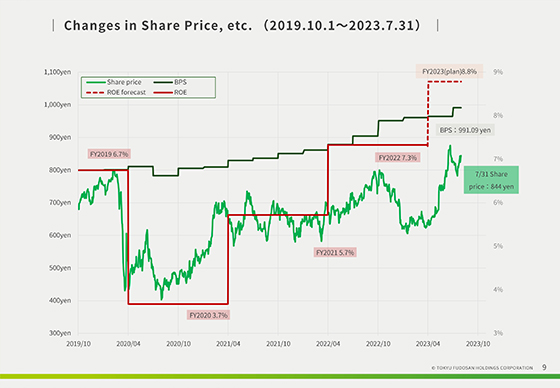

Here are our stock price, BPS, and ROE from October 1, 2019 to July 31, 2023.

Our stock price has declined significantly since late February 2020 due to the spread of the COVID-19 infection,

and our business performance was also greatly affected by the COVID-19.

Thereafter, ROE recovered along with the recovery from the coronary impact,

In the fiscal year ended March 31, 2023, ROE improved to 7.3%, thanks to the favorable real estate market environment and a stronger-than-expected recovery in inbound demand, and we aim for further improvement in the fiscal year ending March 31, 2024.

In the stock market, concerns about changes in the Bank of Japan's monetary policy and other factors are expected to influence macroeconomic and policy trends,

however, the Company intends to achieve a higher ROE level through intensive business restructuring from the fiscal year ending March 31, 2022 to the fiscal year ending March 31, 2023, and to promote stable shareholder returns, such as increased dividends, in line with profit growth.

|

|

|