|

|

|

|

|

|

|

|

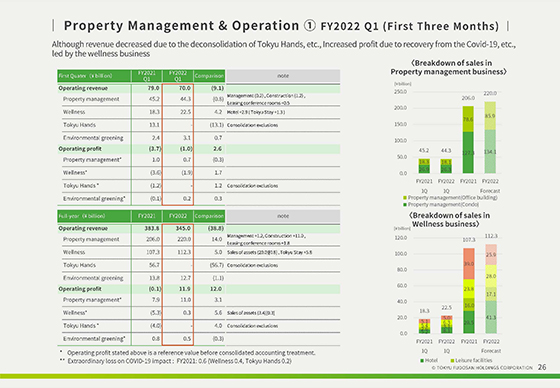

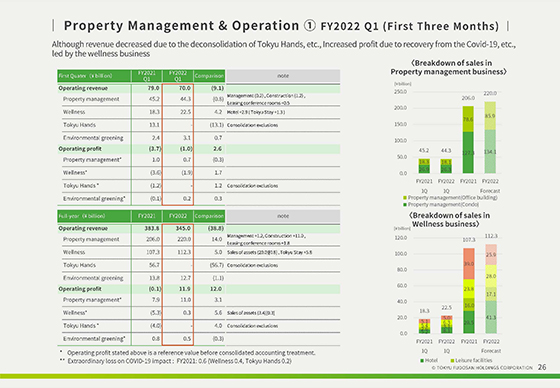

We will now cover our Property Management & Operation segment.

Operating revenue came to 70.0 billion yen and operating losses to 1.0 billion yen, representing a decrease in revenues but an increase in profit over the same quarter in the previous fiscal year.

In the Property Management business, we incurred a decrease in profit due largely to the rebound from construction revenue for condominiums, office buildings and other facilities that we posted in the same quarter in the previous fiscal year.

Under the Wellness business, we posted an increase in profit due to a certain level of recovery from the effects of COVID-19 in hotels and other operations.

Note that in the first quarter under review, we incurred a significant decrease in revenue due to Tokyu Hands being excluded from the scope of consolidation as of March 31, 2022.

Regarding the full-year forecast, we expect a decrease in revenues but an increase in profit year on year as shown in the lower column.

The Property Management business is expected to see an increase in profit due to the strong performance of construction work and rental conference rooms businesses. The Wellness business is also slated to have an increase in profit due to further recovery from the impact of COVID-19 in our hotel and healthcare businesses.

|

|

|