|

|

|

|

|

|

|

|

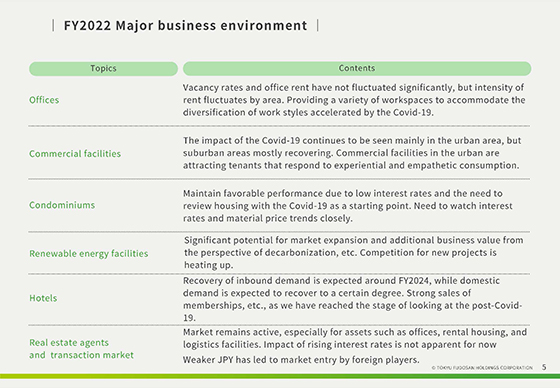

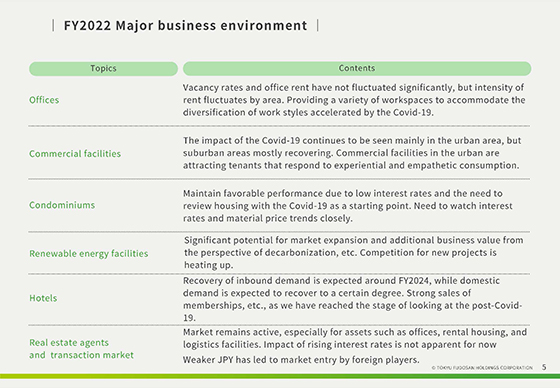

Let’s take a look at the recognition of business environment for our main businesses.

There has been no significant change from our announcement in May.

While no major effect on the vacancy rate and rent has been observed in the Group’s office building business, our performance alternates between favorable and unfavorable depending on the area.

I believe it is important to offer a greater variety of workspaces to meet the requirements, thereby responding to the diversification of work styles accelerated by the pandemic.

For commercial facilities, the impact of COVID-19 has been persisting mainly in the central areas of Tokyo.

Meanwhile, facilities in suburban areas are on the road to recovery.

For facilities in the central area of Tokyo, the Company is focusing particularly on attracting tenants who cater to the needs for experience-based or empathic consumption based.

The condominium market maintained its strong performance against the backdrop of low interest rate environment, increased needs to review housing triggered by COVID-19 and other factors.

Although there has been no immediate impact observed, we need to closely monitor future trends in interest rates and construction costs.

I believe the renewable energy business continues to have great potential for future market expansion and business value enhancement especially in terms of decarbonization.

On the other hand, competition for new projects is heating up in the market on new players’ entry.

In the hotel business, inbound demand is expected to recover around FY2024. However, we anticipate a certain degree of recovery in domestic demand in the business.

With strong membership sales, we recognize we have reached the stage where we can anticipate post-COVID 19 domestic demand.

The Real Estate Agents business and the real estate transaction market are showing briskness particularly for offices, rental housing, logistics facilities and other assets.

Rising interest rates pose no challenges at this time.

Additionally, the weakening yen is ushering foreign players into the market as buyers of properties.

|

|

|