|

|

|

|

|

|

|

|

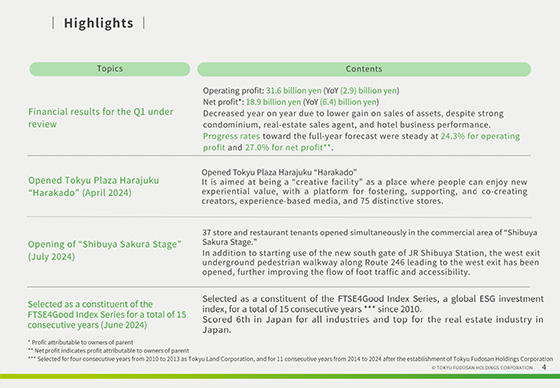

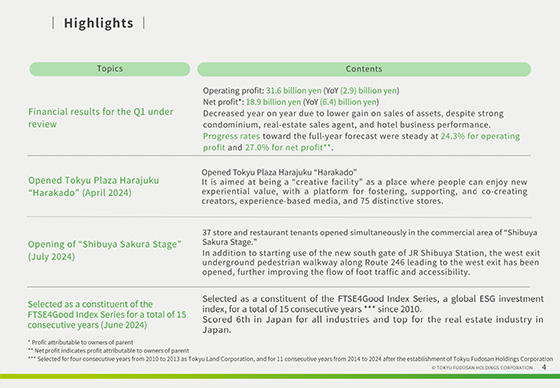

Here are the highlights:

For the first quarter, the Company reported operating profit of 31.6 billion yen and net profit

attributable to owners of parent of 18.9 billion yen, as profit fell year on year owing partly to a

decline in gains from the sale of assets, despite good performance in the condominium sales,

brokerage sales, and hotel businesses.

Our progress rate toward our full-year forecast was steady, at 24.3% for operating profit and 27.0%

for net profit.

Next, some information about Tokyu Plaza Harajuku “Harakado.”

This facility features a platform for creator development, support, and co-creation, hands-on media,

and 75 highly unique stores. It opened in April 2024.

We aim for it to act not as a “commercial facility,” but as a “creative facility,” where visitors

can enjoy new experiential value.

Next, here is some information about the opening of Shibuya Sakura Stage. In July 2024, 37 tenants,

including stores and restaurants, opened in the commercial area of Shibuya Sakura Stage.

In addition to the start of use of the new south exit of JR Shibuya Station, which is directly

connected to this facility, the west exit pedestrian underground walkway has opened, which passes

along National Route 246 in the direction of the west exit. As a result, the flow of foot traffic

and accessibility have been further improved.

Finally, some information about our selection as a constituent of the FTSE4Good Index Series.

We have been selected as a constituent of the FTSE4Good Index Series of global ESG investment

indexes for 15 consecutive years, since 2010.

We obtained the sixth highest score in Japan across all industries, and the highest score in the

real estate industry in Japan. We believe that the ESG initiatives we have been focusing on, as well

as our strategies and business activities, leadership, and engagement with stakeholders, under the

Group policies of environmental management and DX, were rated highly.

|

|

|