|

|

|

|

|

|

|

|

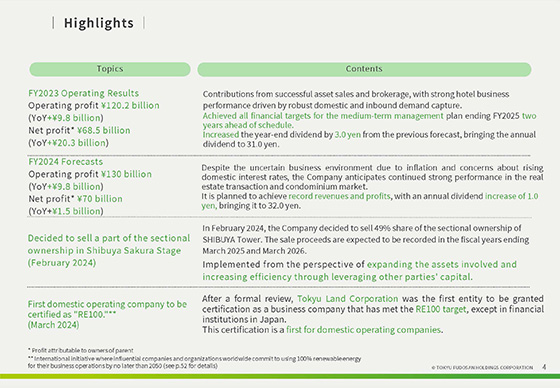

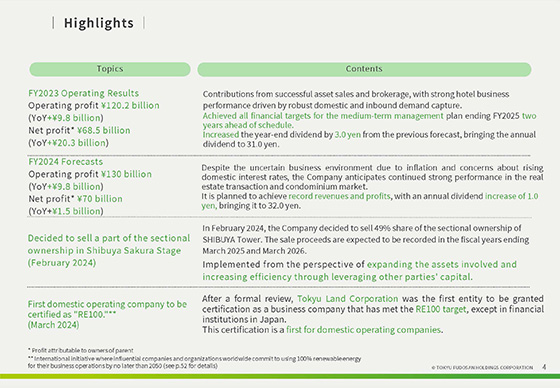

Here are the highlights:

For the fiscal year ended March 31, 2024, the company reported operating profit of 120.2 billion yen

and net profit attributable to owners of parent of 68.5 billion yen, an increase in both revenues

and profit compared to the previous year.

This was due to favorable performance in asset sales and brokerage sales, as well as robust hotel

business due to strong domestic and inbound demand.

We achieved all financial targets for the fiscal year ending March 31, 2026, the final year of our

medium-term management plan, two years ahead of schedule.

The year-end dividend was increased by 3.0 yen from the previous forecast, resulting in an annual

dividend of 31.0 yen and a dividend payout ratio of 32.2%.

Now for the forecast for the fiscal year ending March 31, 2025.

We are targeting operating profit of 130 billion yen and net profit attributable to owners of parent

of 70 billion yen.

Although the business environment remains uncertain due to concerns over rising inflation and

domestic interest rates, we expect the real estate and transaction markets to remain strong.

Both revenues and profits are expected to reach record highs, and the annual dividend is planned to

be increased by 1.0 yen to 32.0 yen.

Next, we would like to discuss the decision to sell a portion of our interest in the Shibuya Sakura

Stage (Shibuya Station Sakuragaoka Block Redevelopment Project), which was completed in November

2023.

On February 8, 2024, we decided to sell the equivalent of a 49% co-ownership interest in the

sectional ownership of the office portion of Shibuya Tower.. The gain from the sale will be recorded

in the fiscal years ending March 31, 2025 and 2026, and as part of the “co-creation with partners”

business policy outlined in the long-term management policy, the sale was implemented from the

perspective of e expanding the assets involved and increasing efficiency through leveraging other

parties’ capital.

Finally, we would like to talk about becoming the first domestic business company to receive RE100

certification.

Tokyu Land Corporation, the core company of the Group, has been certified as having achieved RE100

target following the official assessment by RE100 initiative.

This makes Tokyo Land Corporation the first entity to be granted certification as a business company

that has met the RE100 target, except in financial institutions in Japan. We will continue to

contribute to a decarbonized society through our business.

|

|

|