|

|

|

|

|

|

|

|

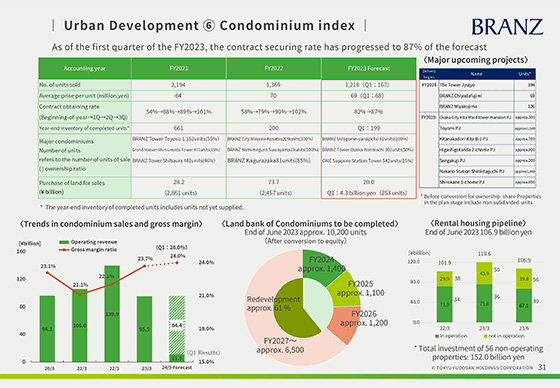

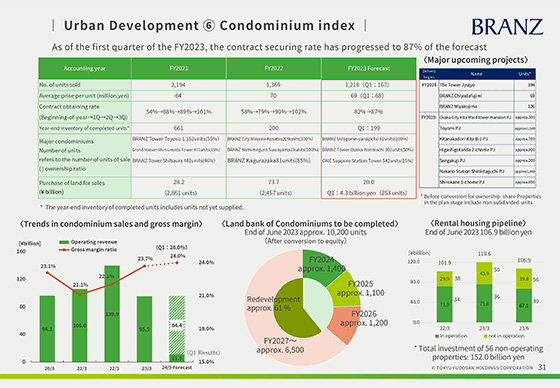

The following are operating indicators for condominiums for sale.

For the fiscal year ending March 31, 2024, we plan to post 1,218 units for sale, sales of 84.4 billion yen, and a gross profit margin of 24.0%.

Sales of condominiums continue to be strong, with the ratio of contracts secured to sales for the fiscal year ending March 31, 2024 at 87% as of the end of June.

The inventory of completed units, which was 200 units at the beginning of the fiscal year ended March 31, 2023, stood at 199 units as of the end of June, due to the progress of sales as well as the simultaneous delivery of new condominiums for sale.

The gross profit margin for condominiums for sale in the first quarter was 28.0% due to the recording of high profit margin properties such as BRANZ Tower Shibaura.

In the acquisition of land for condominiums, we secured 4.3 billion yen for land and 253 units for the number of units, making steady progress toward our full-year plan of 20 billion yen.

The land bank to be recorded after the fiscal year ending March 31, 2025 is approximately 10,200 units, of which redevelopment properties account for approximately 61%.

As noted in the upper right corner, we have a number of large properties, mainly redevelopment properties, in the pipeline for future major projects as well.

We will continue to focus on high-value-added redevelopment properties as we work to strengthen our business.

|

|

|