|

|

|

|

|

|

|

|

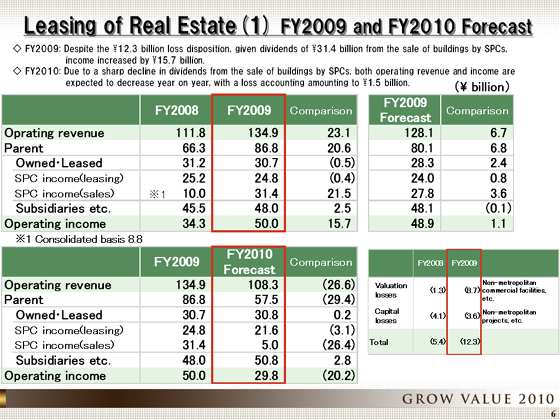

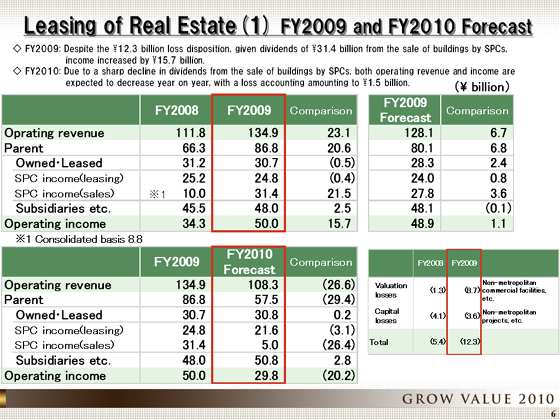

I'll now provide an overview by segment. First, I'll explain our performance in the Leasing of Real Estate segment.

Business performance in the fiscal year ended March 31, 2010, was as follows: operating revenue increased ¥23.1 billion from the previous year to ¥134.9 billion, and operating income increased ¥15.7 billion to ¥50.0 billion.

The breakdown of operating revenue is as follows: for owned and leased, revenue declined year on year primarily due to disposal of owned buildings and canceling of lease agreements; in terms of SPC income, despite the full-year operation of buildings that opened in the previous fiscal year making a contribution, income declined mainly due to the disposal of properties. Meanwhile, revenue from dividends from the sale of buildings by SPCs sharply increased primarily due to the posting of ¥31.4 billion in this category stemming from partial sale of the Shiodome Building, etc.

For operating income, the Company posted a total of ¥12.3 billion losses by implementing accounting losses mainly among non-metropolitan offices and commercial facilities owned by SPCs, consisting of a ¥8.7 billion valuation loss and ¥3.6 billion loss on disposal. However, operating income increased year on year primarily due to the sharp increase in dividends from the sale of buildings by SPCs.

The breakdown of the ¥15.7 billion year on year increase in operating income is as follows: dividends from the sale of buildings by SPCs are ¥22.6 billion, an increase in loss accounting amounted to negative ¥6.9 billion, newly opened properties were ¥3.0 billion, passive damages resulting from disposal of properties were at negative ¥4.0 billion, a decline in rent income from the existing buildings resulted in negative ¥1.0 billion, positive effects of cost reduction were ¥1.0 billion, and positive results of more advantageous SPC interest, etc. were ¥1.0 billion.

The forecast for the fiscal year ending March 31, 2011, shown in the lower column, is as follows: operating revenue is up ¥26.6 billion from the previous year to ¥108.3 billion, while operating income is down ¥20.2 billion year on year to ¥29.8 billion.

The breakdown of expected operating income in the next fiscal year is as follows: dividends from the sale of buildings by SPCs stands at ¥5.0 billion, while income is to decline by ¥26.4 billion. Meanwhile, SPC loss accounting will sharply decrease to within the expected frame of ¥1.5 billion, resulting in an income increase of ¥10.8 billion. The worsening of income in existing buildings, including SPCs, owned and leased, will be ¥1.5 billion, an increase in expenses for development projects of ¥1.5 billion, and ¥1.6 billion in passive damages stemming from disposal of buildings in the previous fiscal year. Operating income is expected to resultantly decline by ¥20.2 billion.

|

|

|