|

|

|

|

|

|

|

|

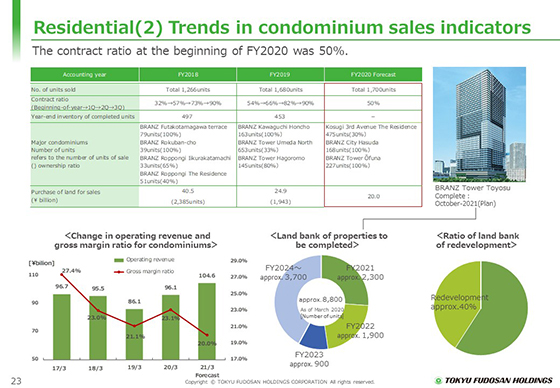

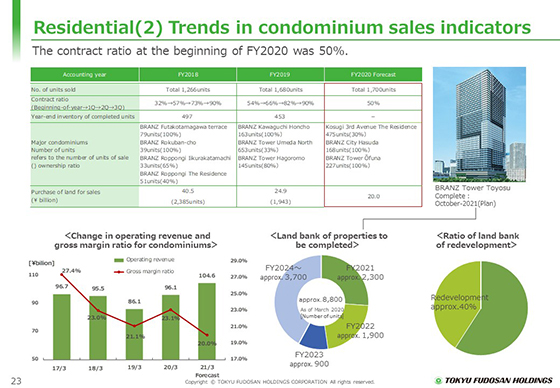

This shows trends in the performance indicators for condominium sales.

We expect that the segment will sell 1,700 units in the fiscal year ending March 31, 2021, the same level as in the previous year. Sales are expected to be 104.6 billion yen.

The contract ratio to the sales forecast for condominiums stood at 50% at the beginning of the fiscal year.

As shown in the lower left, the gross margin ratio of condominiums for the fiscal year ended March 31, 2020 stood at 23.1%. In the fiscal year ending March 31, 2021, the gross margin ratio is expected to be 20.0%.

The inventory of completed units was 453 at the end of March 2020. The inventory has been decreasing since the end of March 2019. We will continue to steadily sell completed units.

We continued to carefully select and purchase land in the fiscal year ended March 2020, which amounted to 24.9 billion yen for 1,943 units.

Units for land banking that will be posted from the fiscal year ending March 31, 2022 amount to approximately 8,800.

The ratio of land bank redevelopment stood at approximately 40%. We will continue to focus on high value-added redevelopment properties.

|

|

|