|

|

|

|

|

|

|

|

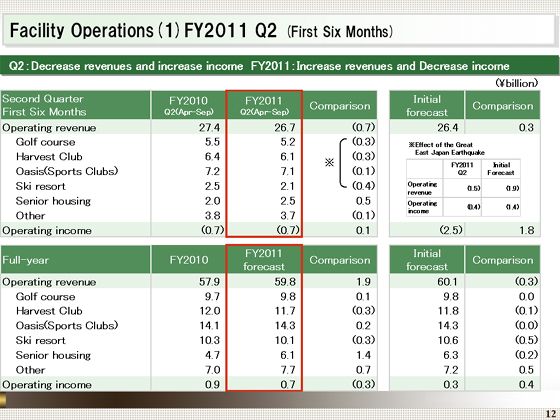

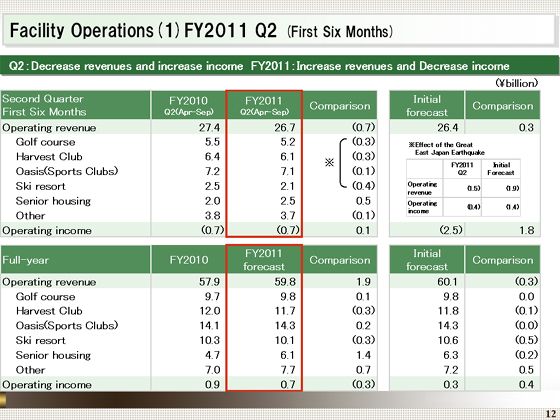

I would now like to move on to describe the Facility Operations segment.

Results in this segment in the first six months of the fiscal year ending March 2012 were as follows: operating revenue declined ¥0.7 billion year on year, to ¥26.7 billion, while operating loss improved ¥0.1 billion, to ¥0.7 billion.

Revenues declined, reflecting a fall in visitors in our golf courses, membership resort hotel Harvest Club, and ski resorts, etc. because of the influence of the Great East Japan Earthquake, although revenues increased in senior housing, thanks to the contribution of new facilities.

Although we had expected that the impact of the Great East Japan Earthquake would result in a decline of ¥1.9 billion in operating revenue and a fall of ¥1.4 billion in operating income for the first half, operating income actually increased as we took steps to reduce expenses, among other initiatives.

For the fiscal year ending March 2012, we expect operating revenue to increase ¥1.9 billion year on year, to ¥59.8 billion, and operating income to decline ¥0.3 billion, to ¥0.7 billion, as shown in the lower table.

Although we expect that revenues will increase as we anticipate higher sales of senior housing facilities and a rise in membership revenues in the Harvest Club, we forecast a fall in income as we continue to anticipate the effect of the Great East Japan Earthquake in ski resorts and other facilities. |

|

|