|

|

|

|

|

|

|

|

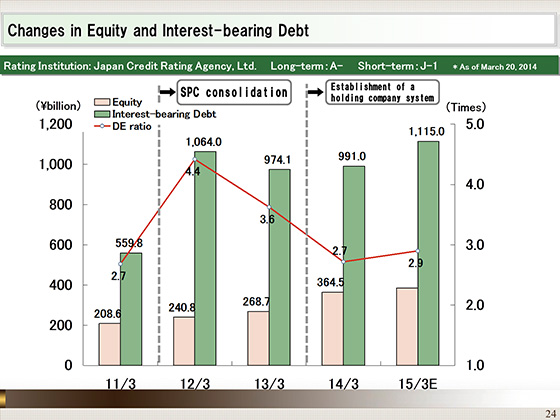

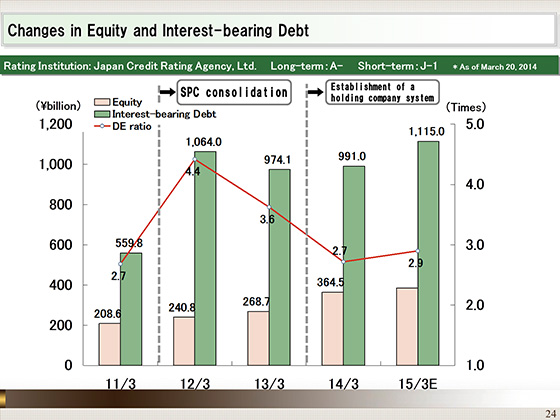

Next, I would like to explain the trend of equity and interest-bearing debt.

Interest-bearing debt increased and the DE ratio rose to 4.4 as a result of the inclusion of an SPCs in the consolidated results at the beginning of the fiscal year ended March 2012. Since then, however, interest-bearing debt has declined, mainly as a result of sales of assets to a REIT, and equity has improved as a result of the recording of term profits and the establishment of a holding company system. Consequently, the DE ratio declined to as low as 2.7 at the end of the fiscal year ended March 2014.

In the fiscal year ending March 2015, we plan to make new investments under the policy of proactive investment when an opportunity to acquire quality properties arises to accelerate the replacement of our portfolio and our cyclical reinvestments. As a result, we expect that interest-bearing debt will rise to ¥1,115 billion and the DE ratio will become 2.9.

From JCR, we have received a long-term issuer rating of A- and an outlook of Stable. In November 2013, we issued seven-year corporate bonds at an interest rate of 0.639%. We continue to enjoy sound financing conditions.

|

|

|