INVESTOR RELATIONS

Performance History

Progress in Financial Results

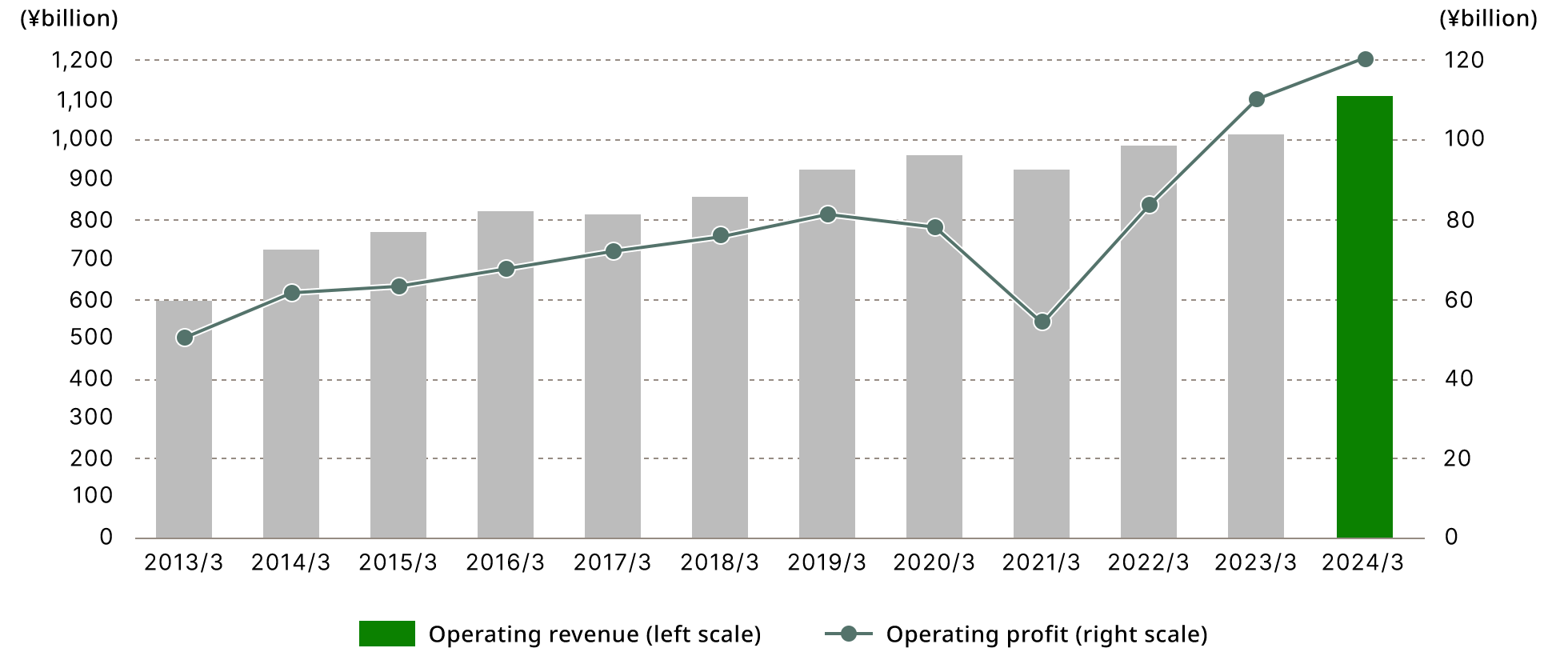

Operating Revenue and Operating Profit

You can scroll this table sideways

2025/3

Financial Results (Consolidated) 2025/3

The Group’s business performance during the fiscal year ended March 31, 2025 showed increases both in revenue and profit, with increases in operating revenue, operating profit, ordinary profit, and profit attributable to owners of parent, all of which are record highs,including the period before shifting to a holdings structure. There was ¥1,150.3 billion in operating revenue (up 4.3% from the previous fiscal year), ¥140.8 billion in operating profit (up 17.1%), ¥129.2 billion in ordinary profit (up 17.0%), and ¥77.6 billion in profit attributable to owners of parent (up 13.2%) owing to robust performance in the condominium business and real estate sales agent business against the backdrop of a strong property market for real estate, strong performance in the hotel business from capturing high inbound demand, etc.

2024/3

Financial Results (Consolidated) 2024/3

The Group’s business performance in the fiscal year ended March 31, 2024, owing to strong performance in sales of assets and the real estate sales agent business against the backdrop of a strong real estate market, strong performance in the hotel business as a result of having tapped into demand in Japan and overseas, etc., showed increases both in revenues and profit with ¥1,103.0 billion in operating revenue (up 9.7% from the previous fiscal year), ¥120.2 billion in operating profit (up 8.9%), and ¥110.4 billion in ordinary profit (up 10.9%).

In the fiscal year ended March 31, 2024, profit attributable to owners of parent increased substantially to ¥68.5 billion (up 42.1%), which is attributable to extraordinary losses of ¥31.3 billion having been recorded in the previous fiscal year mainly due to progress in business restructuring based on the medium-term management plan 2025.

In the fiscal year ended March 31, 2024, the Group achieved record highs, including the period before shifting to a holdings structure, for operating revenue, operating profit, ordinary profit and profit attributable to owners of parent. The Group also achieved operating profit target of ¥120.0 billion and profit target of ¥65.0 billion for the fiscal year ending March 31, 2026, the final fiscal year of the medium-term management plan, two years ahead of schedule.

2023/3

Financial Results (Consolidated) 2023/3

Results for the fiscal year ended March 31, 2023 showed increases in revenues and profit with ¥1,005.8 billion in operating revenue (up 1.7% from the previous fiscal year), ¥110.4 billion in operating profit (up 31.7%), and ¥99.6 billion in ordinary profit (up 36.7%), due to strong performance in the sales market and sales of condominium units against the backdrop of a strong real estate market, as well as a recovery in the hotel business due to the easing of activity restrictions and border controls among other factors.

Due to business restructuring to improve efficiency based on the medium-term management plan 2025, as a result of the recording of ¥1.9 billion in gain on sale of shares of subsidiaries and associates, etc. as extraordinary income (¥7.1 billion in extraordinary income in the previous fiscal year) and ¥31.3 billion in impairment losses, etc. as extraordinary losses (¥24.0 billion in extraordinary losses in the previous fiscal year), ¥48.2 billion in profit attributable to owners of parent (up 37.3%) was recorded.

In the fiscal year ended March 31, 2023, the Group achieved record highs, including the period before shifting to a holdings structure, for operating revenue, operating profit, ordinary profit and profit attributable to owners of parent.

2022/3

Financial Results (Consolidated) 2022/3

During the fiscal year ended March 31, 2022, with regard to the Japanese economy, amid a protracted effect of the spread of COVID-19, efforts to regain normalcy in social and economic activities have been proceeding, such as the progression of vaccination, and the lifting of activity restrictions, and recovery can be observed albeit it lacking strength. At the same time, because of the current surge in raw material prices such as crude oil, a rising price of goods and tightening of financial markets can be seen worldwide, which is causing uncertainty to continue for the economic outlook overall.

The Group also faced difficulties due to the continued impact of the temporary closing or reduction in operating hours of commercial facilities, managed facilities, and retail stores mainly in the first quarter ended June 30, 2021, and reduction in operating hours in the second quarter ended September 30, 2021 and onward, based on the state of emergency declared by the Japanese government and requests from local governments due to the spread of COVID-19. However, results have recovered significantly, since the areas subject to measures under the state of emergency declaration and restrictions were limited compared to the previous state of emergency declaration, which has been declared in the fiscal year ended March 31, 2021. Moreover, the Group achieved record high operating profit in the fiscal year under review. This was mainly due to a large office building having its first full-year of operation in office leasing, an increase in gains on sale in asset sales due to strong activity in the real estate transaction market, and strong sales performance in condominium unit sales and the real estate agents business in the residential market on the back of diversifying needs among customers and a continuation of low interest environment, etc.

Results for the fiscal year ended March 31, 2022 showed increases in revenues and profit with ¥989.0 billion in operating revenue (up 9.0% from the previous fiscal year), ¥83.8 billion in operating profit (up 48.3%), ¥72.8 billion in ordinary profit (up 56.4%) and, as a result of the recording of ¥7.1 billion in gain on sale of shares of subsidiaries and associates, etc. as extraordinary income (¥7.3 billion in extraordinary income in the previous fiscal year), ¥24.0 billion in impairment losses, etc. as extraordinary losses (¥12.0 billion in extraordinary losses in the previous fiscal year), ¥35.1 billion in profit attributable to owners of parent (up 62.1%).

2021/3

Financial Results (Consolidated) 2021/3

During the fiscal year ended March 31, 2021, with regard to the Japanese economy, economic activity was restricted and severely affected by people refraining from going out, a significant decrease in the number of foreign visitors to Japan, and other factors as a result of the declaration of a state of emergency in Japan in April 2020 due to the spread of the novel coronavirus disease (COVID-19). Although the economy has continued to recover following the lifting of the state of emergency, the outlook for the economy as a whole still remains uncertain amid uncertainty regarding when COVID-19 will be brought under control as there continues to be a trend of refraining from going out and restrictions on travel, as well as other factors including a declaration of second state of emergency in January 2021 due to a resurgence of COVID-19.

Under this type of environment, the Group has faced significant restrictions on business activities of all segments, mainly due to the temporarily closing or reduction in operating hours of commercial facilities, facilities and retail stores in the first quarter ended June 30, 2020. After the lifting of the state of emergency, operations gradually resumed, and results in the second quarter ended September 30, 2020 and thereafter are on a recovery trend due to various government measures, etc., but the effects have continued mainly due to the trend of refraining from going out in response to the resurgence of COVID-19.

Results for this fiscal year ended March 31, 2021 showed decreases in both revenues and profit with ¥907.7 billion in operating revenue (down 5.8% from the previous fiscal year), ¥56.5 billion in operating profit (down 28.7%) and ¥46.6 billion in ordinary profit (down 31.0%) due to the impact of the spread of COVID-19, mainly in the Wellness business and Tokyu Hands business, despite an increase in revenues and profit in the Urban Development business because of newly opened development projects and an increase in revenues from sales of properties including buildings for investors, and operation projects in the renewable energy business, as well as ¥21.7 billion in profit attributable to owners of parent (down 43.9%) due to the recording of loss, etc. as extraordinary losses due to COVID-19.

2020/3

Financial Results (Consolidated) 2020/3

Results for this fiscal year ended March 31, 2020 showed ¥963.2 billion in operating revenue (up 6.8% from the previous fiscal year), ¥79.3 billion in operating profit (down 1.1%), ¥67.5 billion in ordinary profit (down 4.6%) and ¥38.6 billion in profit attributable to owners of parent (up 3.1%).

Reflecting continued strong performance of the real estate market, both revenues and profit increased in the Urban Development segment, Residential segment, Property Management segment and Real-Estate Agents segment. On the other hand, due to the impact of the spread of COVID-19, both revenues and profit decreased in the Wellness segment, Tokyu Hands segment and other segments. As a result, regarding results for this period, revenues increased but operating profit decreased. However, profit attributable to owners of parent increased due to a decrease in extraordinary losses.

2019/3

Financial Results (Consolidated) 2019/3

Results for this fiscal year ended March 31, 2019 showed ¥901.9 billion in operating revenue (up 4.1% from the previous fiscal year), ¥80.2 billion in operating profit (up 3.5%), ¥70.7 billion in ordinary profit (up 3.0%) and ¥37.5 billion in profit attributable to owners of parent (up 6.5%).

Reflecting continued strong performance of the real estate market, both revenues and profit increased due to an increase in the delivery of new facilities and greater property sales in the Wellness segment, and to the strong performance in the Real-Estate Agents segment, although there was a decrease in revenues due to declined revenues from sales of properties including buildings for investors in the Urban Development segment, and a decrease in the number of condominium units sold in the Residential segment.

2018/3

Financial Results (Consolidated) 2018/3

Results for this fiscal year ended March 31, 2018 showed ¥866.1 billion in operating revenue (up 7.1% from the previous fiscal year), ¥77.5 billion in operating profit (up 5.9%), ¥68.7 billion in ordinary profit (up 8.0%) and ¥35.2 billion in profit attributable to owners of parent (up 11.6%).

Reflecting continued strong performance of the real estate market, both revenues and profit increased mainly due to an increase in revenues from sales of properties including buildings for investors, improvement in lease revenues from existing buildings, and a contribution from NATIONAL STUDENTS INFORMATION CENTER, which became a consolidated subsidiary in the previous fiscal year, in the Urban Development segment, as well as to a strong performance in the Real-Estate Agents segment.

2017/3

Financial Results (Consolidated) 2017/3

Results for this fiscal year ended March 31, 2017 showed ¥808.5 billion in operating revenue (down 0.9% from the previous fiscal year), ¥73.2 billion in operating profit (up 6.5%), ¥63.6 billion in ordinary profit (up 12.9%) and ¥31.5 billion in profit attributable to owners of parent (up 9.7%).

Although revenues decreased due partly to lower revenues from sales of properties including buildings for investors in the Urban Development segment, profit increased mainly due to higher profit from sales of condominiums in the Residential segment and to strong performance in the Real-Estate Agents segment and the Wellness segment, specifically at Tokyu Stay urban style hotels.

Shibuya redevelopment 2 project start

2016/3

Financial Results (Consolidated) 2016/3

Results for this fiscal year ended March 31, 2016 showed ¥815.5 billion in operating revenue (up 5.5% from the previous fiscal year), ¥68.8 billion in operating income (up 8.6%), ¥56.4 billion in ordinary income (up 9.1%) and ¥28.7 billion in profit attributable to owners of parent (up 13.8%).

Revenues increased mainly due to strong performance in the Real-Estate Agents segment and increased bulk sales of land in the Residential segment and profit increased thanks in part to higher gains on sales of properties including buildings for investors in the Urban Development segment.

2015/3

Financial Results (Consolidated) 2015/3

Results for this fiscal year ended March 31, 2015 showed ¥773.1 billion in operating revenue (up 8.3% from the previous fiscal year), ¥63.3 billion in operating income (up 3.0%), ¥51.7 billion in ordinary income (up 2.2%) and ¥25.2 billion in net income (up 6.4%).

Both revenues and profit increased mainly due to an increase in revenues from sales of properties including buildings for investors and the start of new facilities operations in the Urban Development segment. Net income increased mainly due to an improvement in minority interests in income (loss) following the shift to a holding company system.

2014/3

Financial Results (Consolidated) 2014/3

Results for this fiscal year ended March 31, 2014 showed an increase in revenues and profit with ¥714.1billion in operating revenue (up 19.8% from the previous year), ¥61.4 billion in operating income (up 18.2%) and¥50.6 billion in ordinary income (up 26.8%), thanks mainly to an increase in sales of condominiums, strong sales in the real-estate sales agent business and the consolidation of United Communities Co., Ltd. as a subsidiary.

Net income increased to ¥23.7 billion (up 7.1%). This was mainly due to an increase in minority interests in income, in spite of the recording of gain on sales of non-current assets of ¥8.4 billion from the transferring of assets to Activia Properties Inc. in the previous year.

2013/3

Financial Results (Consolidated) 2013/3

Results for this fiscal year ended March 31, 2013 showed an increase in revenues and profit with ¥595.9 billion in operating revenue (up 7.0% from the previous year). ¥52.0 billion in operating income (up 3 .8%) and ¥39.9 billion in ordinary income (up 14.5%). This was the result of an increase in sales in the Real Estate Sales segment and strong sales in the real-estate sales agent business in the Real-Estate Agents segment. Following the listing of Activia Properties Inc. in June 2012, which entrusts the Company's wholly-owned subsidiary. TLC Activia Investment Management Inc., with its asset management, part of the commercial facilities and office buildings owned by the Company and its consolidated subsidiaries were transferred to Activia Properties. As a result, gain on sales of noncurrent assets of ¥8.4 billion was recorded as extraordinary income. Net income decreased to ¥22.1 billion (down 35.2%). This was mainly the result of a decrease in extraordinary income and loss and an increase in tax expenses.