INVESTOR RELATIONS

For Investors

We will provide an easy-to-understand introduction to the company's business overview and medium to long-term management plans.

Toward Vibrant Future for All

1.The Group Philosophy

We aspire to create value for the future to realize a sustainable society and growth, based on a Group Philosophy comprising our ideal vision, our pledge to society, and our founding spirit.

Our ideal vision

Create value for the future

We resolve social issues through our business activities and aim for sustainable society and growth together with our stakeholders.

We realize a future where everyone can be themselves and shine vigorously through the creation of a variety of appealing lifestyles.

Our pledge to society

We believe that corporate value is the sum total of the levels of satisfaction of all of our stakeholders.

-

- Customers

- Always coming face-to-face with customers, we will provide value that will ensure that we continue to be chosen by them.

-

- Business partners

- We will create value in partnerships and aim to achieve growth together with our partners.

-

- Shareholders and investors

- We will maximize shareholder value through sustainable growth.

-

- Group employees

- We develop human capital who can tackle challenges and create workstyle environments where Group employees can work actively.

-

- Local communities

- We will contribute to a sustainable society by initiatives to coexist with communities and revitalize them.

-

- Future society

- We aspire to pass on to future generations a world full of hope with a rich environment.

Our founding

spirit

Challenge-oriented DNA

A progressive spirit inherited since the development of Den-en Chofu, a pioneering effort to create the ideal town

Eiichi Shibusawa

1840–1931

Established the Den-en Toshi Company, the origin of the Group

Eiichi Shibusawa is often referred to as the father of Japanese capitalism for his role in building the foundation for the Japanese economy. He was active from the Meiji era (1868–1912) into the early Showa period (1926–1989). He was involved in the establishment and development of around 500 companies and around 600 public works projects, and made great efforts in support of philanthropic activities.

Provided by: Tokyu Corporation

Noboru Goto

1916–1989

First president of Tokyu Land Corporation

Noboru Goto led the Tokyu Group as the first president of Tokyu Land Corporation. He engaged in large-scale urban development and resort development projects, as well as serving as chairman of the Japan Chamber of Commerce and Industry (JCCI).

2.Message from the President

Based on the Medium-Term Management Plan, Tokyu Fudosan Holdings Corporation's present policy for shareholder returns is to aim for a dividend payout ratio of 30% or more and maintain a stable stream of dividends.

Under the slogan "WE ARE GREEN," the Tokyu Fudosan Holdings Group is endeavoring to create a variety of appealing lifestyles. To this end, we respect all values, embrace diversity, and accept different ideas and ways of thinking. At the same time, we will foster a sense of unity among all Group members while empowering every member of our workforce to realize their individual strengths. By doing so, we will work together with our stakeholders to create a sustainable society and achieve mutual growth, aiming to realize a future where everyone can be themselves and shine brightly.

We hereby express deepest gratitude to our shareholders who have supported our operations to this day and ask for their ongoing patronage and cooperation.

May 2025

President & CEO

3.Company Profile Overview

A History of Value Creation

The origins of the Group lie with the Den-en Toshi Company, which was established by Eiichi Shibusawa and his associates in 1918. During an era of housing shortages in Tokyo due to urban development and population inflow, they adopted the “Garden City” concept that originated in England and created Den-en Chofu, which combines the advantages of both nature and the city. Over more than 100 years since, we have continued to pass down their high aspirations as “Challenge-oriented DNA” and work towards resolving various social issues.

History

| 1918 | Den-en Toshi Co. established |

|---|---|

| 1923 |

Den-en Toshi Co. begins selling real estate in the residential community of Senzoku and in Tamagawadai (now Den-en Chofu) in Japan's first "garden city" development project  |

| 1928 | Meguro-Kamata Railway Co., Tokyu Corporation's predecessor, merges with Den-en Toshi Co. |

| 1953 |

Tokyu Corporation spins off real estate division that becomes Tokyu Land Corporation (TLC)  |

| 1956 | TLC listed on the Second Section of the Tokyo Stock Exchange(reassigned to the First Section of TSE in 1961) |

| 2013 | Comforia Residential REIT, Inc. listed on the Tokyo Stock Exchange Tokyu Community Corp. acquires shares in United Communities Co., Ltd.TLC, Tokyu Community Corp., and Tokyu Livable, Inc. delistedTokyu Fudosan Holdings Corporation established. (three companies delisted) |

Major Shareholder Information

(As of September 30,2025)

| Name of shareholder | Number of shares held (thousand shares) | Percent of total shares issued |

|---|---|---|

| TOKYU CORPORATION | 114,479 | 15.90% |

Tracing its roots back to The Den-en Toshi Company established in 1918, Tokyu Fudosan Holdings Company was previously Tokyu Land Corporation, which was spun off from the real estate division of Tokyu Corporation's predecessor in 1953.

We are an equity-method affiliate of Tokyu Corporation. We share the Tokyu brand as a member of Tokyu group and

contribute to enhancing the value of the group while aiming for boosting the corporate value and shareholder value through the growth of our group.

Holding Structure

Tokyu Fudosan Holdings Group consists of Tokyu Fudosan Holdings Corporation, a holding company that was established in October 2013, Main operating companies (TOKYU LAND CORPORATION, TOKYU COMMUNITY CORP., Tokyu Livable, Inc., Tokyu Housing Lease Corporation, and NATIONAL STUDENTS INFORMATION CENTER Co., Ltd., TFHD Energy Corporation), and other consolidated subsidiaries. About 30,000 employees from more than 100 Group companies work to create value in the Group.

About Our Group Businesses

A broad business wingspan with multifaceted businesses

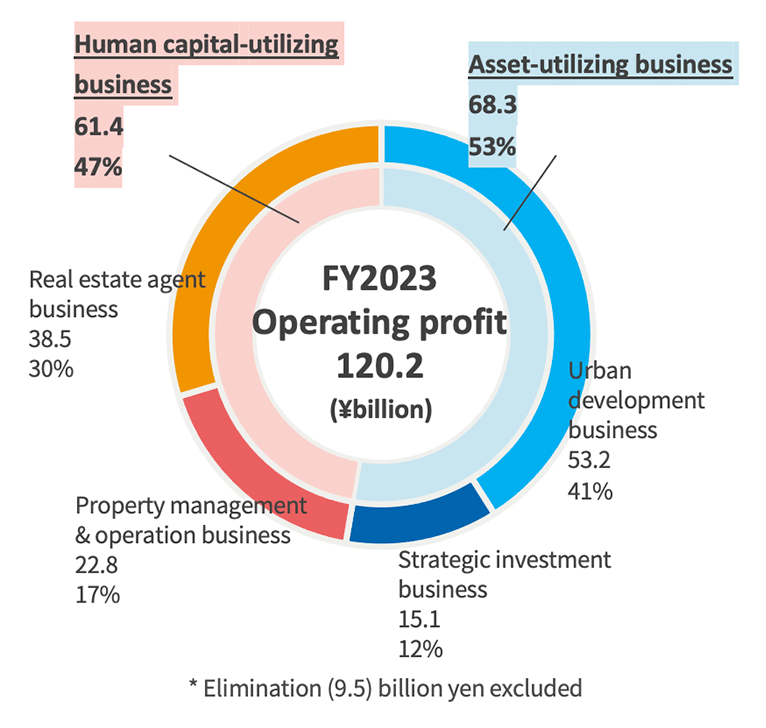

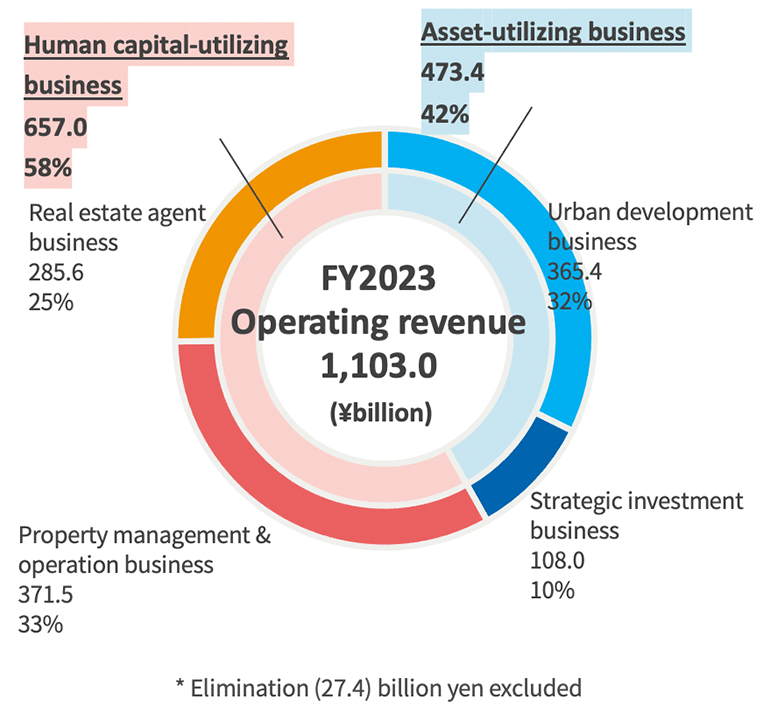

FY2024 Operating revenue composition ratio

FY2024 Operating profit composition ratio

End of FY2024 Total assets ratio

Our Businesses

Note:Next update scheduled: March 2026

Diverse Assets and Customers

Group facilities under operation

Customers served

Approx.

million

*1Tenant companies (office)

546

Tenant companies (commercial)

1,315

Condominium units under management

Approx.

815,000

Condominium management company (non-consolidated)

Condominium units under comprehensive management (approx. 474,000)

(Source: Mansion Kanri Shimbun, May 25, 2025 issue)

No.

2

in Japan

Real estate transactions through agents

Approx.

33,000

FY2024 annual turnover

Approx.

¥2.2

trillion

2

consecutive years as

No.1

*2

*1including commercial facility cardholders and app members, BRANZ CLUB members, Tokyu Cosmos Members Club members, Tokyu Harvest Club members, and outsourced employee welfare services members with EWEL, Inc. (as of April 2025 switched from consolidated subsidiary to equity method affiliated company)

*2real estate turnover through agents, based on press reporting (results of survey of transactions from 20-30 major real estate agents chosen by industry press, each surveyed between April 2023 and March 2024, and between April 2024 and March 2025)

Renewable energy business

ReENE

As of September, 2025

Rated Capacity

2,112

MW

Total number of businesses

156

Office building ratio of four central wards of Tokyo

95

%

Vacancy rate

4.8

%

Currently, 95% of office buildings owned by Tokyu Land and consolidated silent partnerships are located in the four central wards (Chiyoda, Chuo, Minato, Shibuya) of Tokyo.

Vacancy rate excluding Shibuya Sakura Stage: 1.1%

As of March 31, 2025

Development in the Greater Shibuya Area

Advancing multiple projects focused on the Greater Shibuya Area, a 2.5-kilometer radius centered on Shibuya Station

Financial Data

Operating Revenue

Operating Profit

Ordinary Profit

Net Profit*・EPS**

* Profit attributable to owners of parent

** Net income per share

4.Management Strategy

In May 2021, Tokyu Fudosan Holdings announced its GROUP VISION 2030 long-term vision and then, in May 2025, the Group announced our Medium-term management plan 2030. The value we are seeking to create involves creating highly attractive, diverse lifestyles that can help build a future in which everyone can be themselves and shine vigorously. Our ultimate aim is to leverage Group strengths to realize our ideal vision and achieve sustainable growth.

Medium-Term Management Plan 2030

Long-Term Vision [GROUP VISION 2030]

Realize our ideal vision by promoting the long-term management policy formulated based on the materialities.

![Long-term vision [GROUP VISION 2030]](/img/english/ir/individual/for_investors/investors04-02-01.png)

We aim to be a corporate group that continues to create value by transforming the Group's distinctive features of environmental management and DX into strengths.

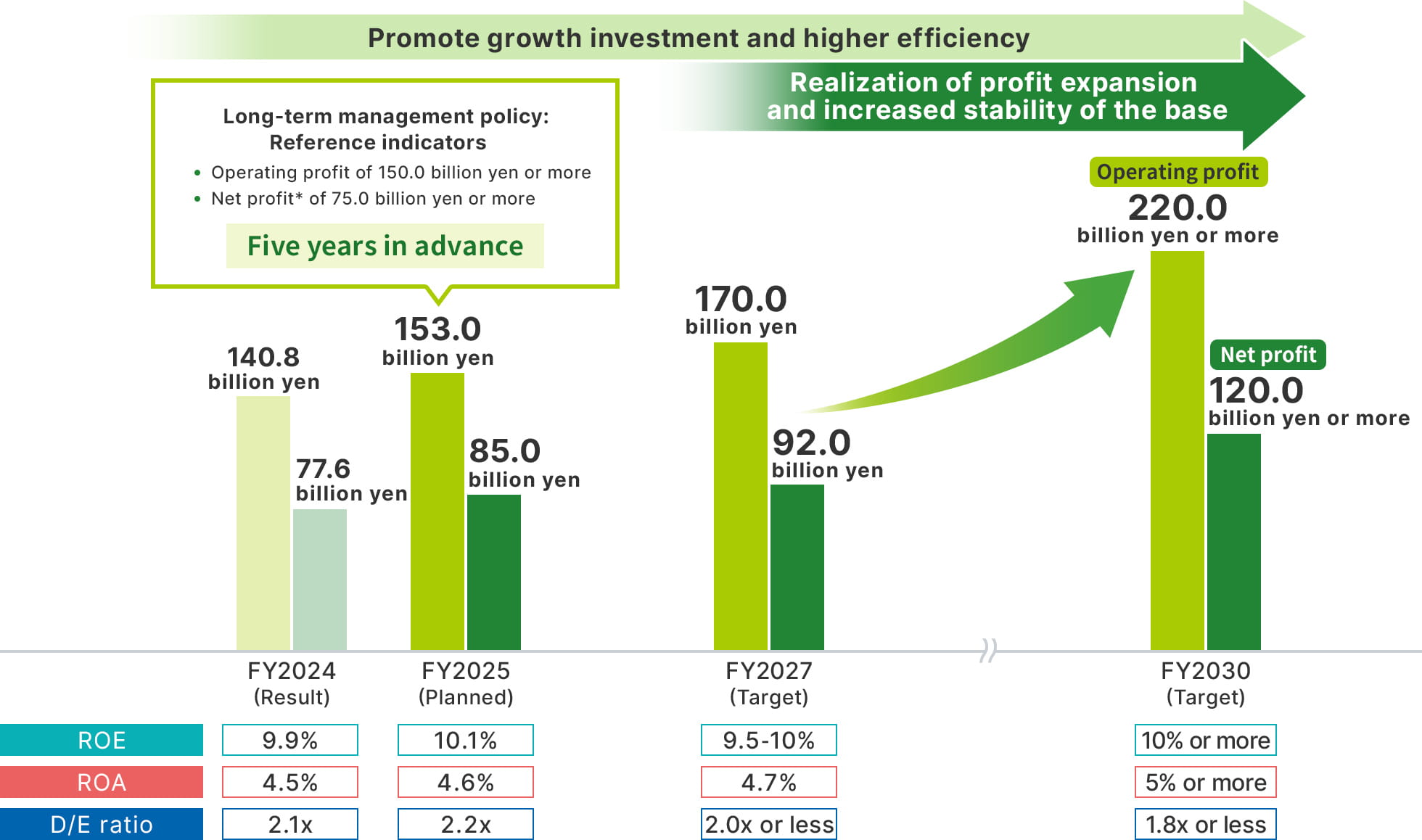

Transitions in Target Indicators (financial indicators)

[As of March 9, 2025]

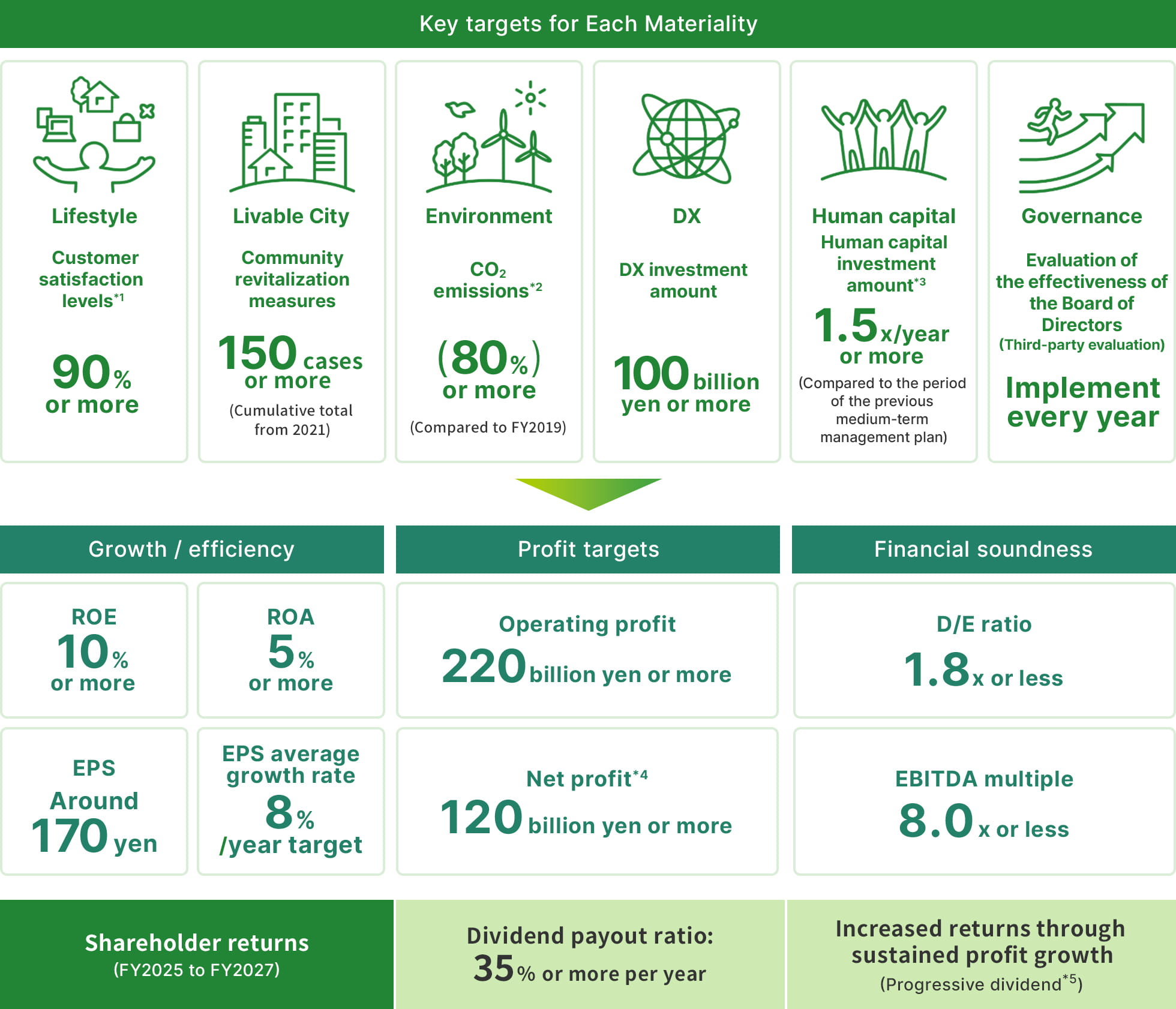

Target Indicators for Fiscal 2030

Aim to achieve target indicators that integrate financial and non-financial data based on materialities.

*1: Detailed targets are set separately. *2: Tokyu Cosmos Members Club questionnaire *3: Scope 1 & 2 under SBT certification *4: Profit attributable to owners of parent

External Evaluation Summary

5.Return to Shareholders

We will maintain a stable dividend payout ratio of at least 35% for the foreseeable future.

6.Reference Information

Media(official YouTube)