BUSINESS INTRODUCTION

Tokyu Fudosan Holdings in Figures

Diverse assets and customers

Group facilities under operation

Customers served

Approx.

Tenant companies (office)

533

Tenant companies (commercial)

1,413

Condominium units under comprehensive management

Approx.

506,000

Condominium management company (non-consolidated)

Condominium units under comprehensive management (approx. 484,000)

(Source: Mansion Kanri Shimbun, May 25, 2024 issue)

No.

2

in Japan

Real estate transactions through agents

Approx.

30,000

Includes outsourced employee welfare services members, commercial facility cardholders and app members, fitness club members, BRANZ CLUB members, Tokyu Cosmos Members Club members, and Tokyu Harvest Club members

Highly specialized personnel and knowhow

Group employees

(including temporary employees)

Approx.

Acquiring external knowledge and sharing expertise within the Group

Cumulative

119

events held

We invite external experts to give self-development seminars. We also hold seminars led by internal instructors with the aim of encouraging mutual understanding between businesses and strengthening collaboration within the Group alongside other events.

Employees with certifications

Approx.

Licensed architects (first and second class)

520

Real estate notaries

7,317

Licensed condominium managers

2,341

Licensed strata management consultants

515

Licensed care workers

434

IT Passport holders

1,097

A culture that produces unique businesses

Renewable energy business

「ReENE」

As of January, 2025

Rated Capacity

1,893

MW

Total number of businesses

128

the Group's co-creation-based internal venture scheme

「STEP」

Launched in FY2019

Cumulative proposals received

302

Commercialized proposals

4

Corporate Venture Capital

Launched in FY2017

Cumulative investments

37

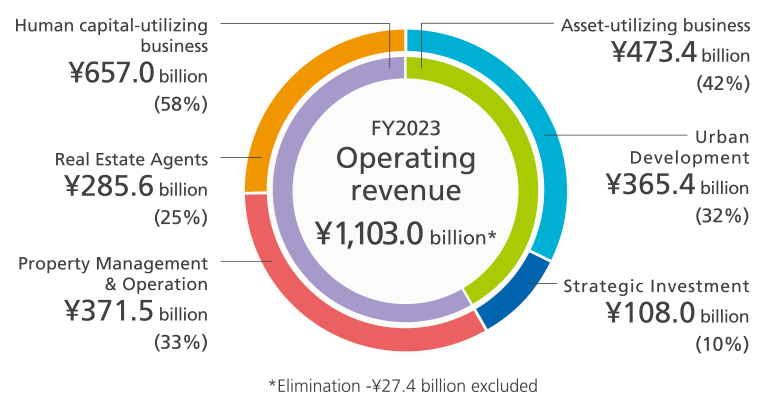

FY2023 Operating revenue composition ratio

Operating revenue for FY2023 was 1,103.0 billion yen, up 9.7% from the previous fiscal year. Revenue increased in all segments, including Urban Development, Strategic Investment, Property Management and Operation, and Real Eestate Agent.

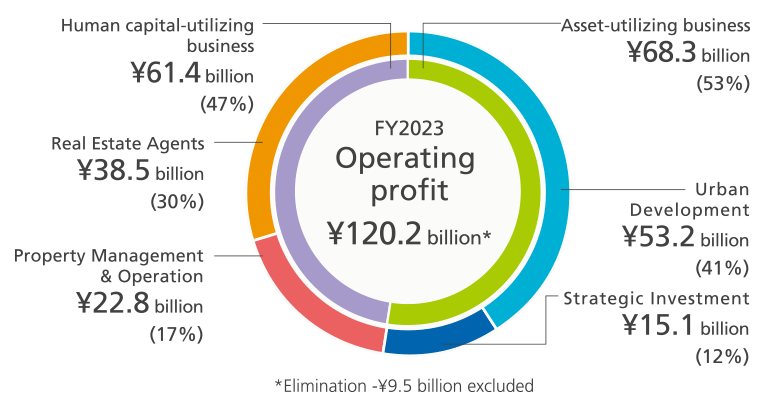

FY2023 Operating profit composition ratio

Operating profit for FY2023 was 120.2 billion yen, up 8.9% from the previous year. The increase was due to strong asset sales and brokerage sales against the backdrop of a robust real estate market, as well as strong performance in the hotel business as a result of capturing domestic and overseas demand. The target of 120.0 billion yen for FY2025, the last year of the medium-term management plan, was achieved two years ahead of schedule.

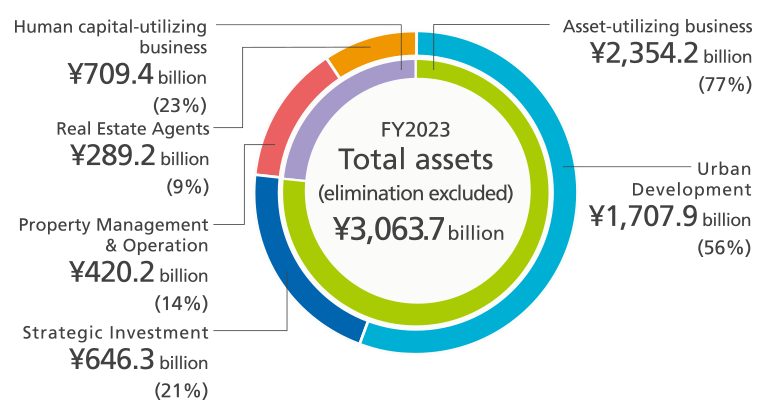

End of FY2023 Total assets ratio