COMPANY INFORMATION

Letter to Our Stakeholders

A century later, we still carry the “challenge-oriented DNA” of our founding spirit

After more than 25 years of redevelopment work, Shibuya Sakura Stage has finally opened its doors to the public, bringing a new buzz to Shibuya. Charged with meeting the expectations of the many leaseholders who have been eagerly waiting for this day, we are going to make this endeavor blossom like a great flower in the Sakuragaoka neighborhood of Shibuya, a center of diverse, thriving cultures.

Tokyu Land Corporation, the core company of Tokyu Fudosan Holdings, was established in 1953 in this very same area in Shibuya. In a speech made during the announcement of Tokyu Land Corporation’s establishment, Keita Goto, the company’s first chairman, stated, “We would like to construct four or five more high-rise buildings in the vicinity of Shibuya Station and contribute to the development and improvement of the area centering on Shibuya.” The company’s aim at the time, to “greatly expand business and break into projects of national importance,” is now being realized through the once-in-acentury undertaking that is the redevelopment of Shibuya.

The origin of our Group can be traced back to the Den-en Toshi Company, founded in 1918 by Eiichi Shibusawa and others. More than 100 years ago, we were the first in Japan to engage in community development incorporating the British-oriented garden city concept in the Den-en Chofu neighborhood, greatly improving the living environment for urban dwellers.

From that time forward, with the “challenge-oriented DNA” of our founding spirit, we have been committed to developing new businesses and services that provide solutions to the social issues of the times.

Tokyu Plaza Harajuku “Harakado,” which opened in April 2024, is one example. After the COVID-19 pandemic, we took on the challenge of redefining the commercial facility and positioned it as a device for attracting creators. Many of the facility’s visitors have praised it for presenting a new ideal for how a gathering space should be. At this turning point in our society as we transition toward an inflationary economy, we will instill in the Group a culture that will enable us to continue to proactively take on such challenges and grow into a strong organization that remains customers’ choice.

Achieving our goals two years ahead of schedule and taking on the challenge of forward-looking change

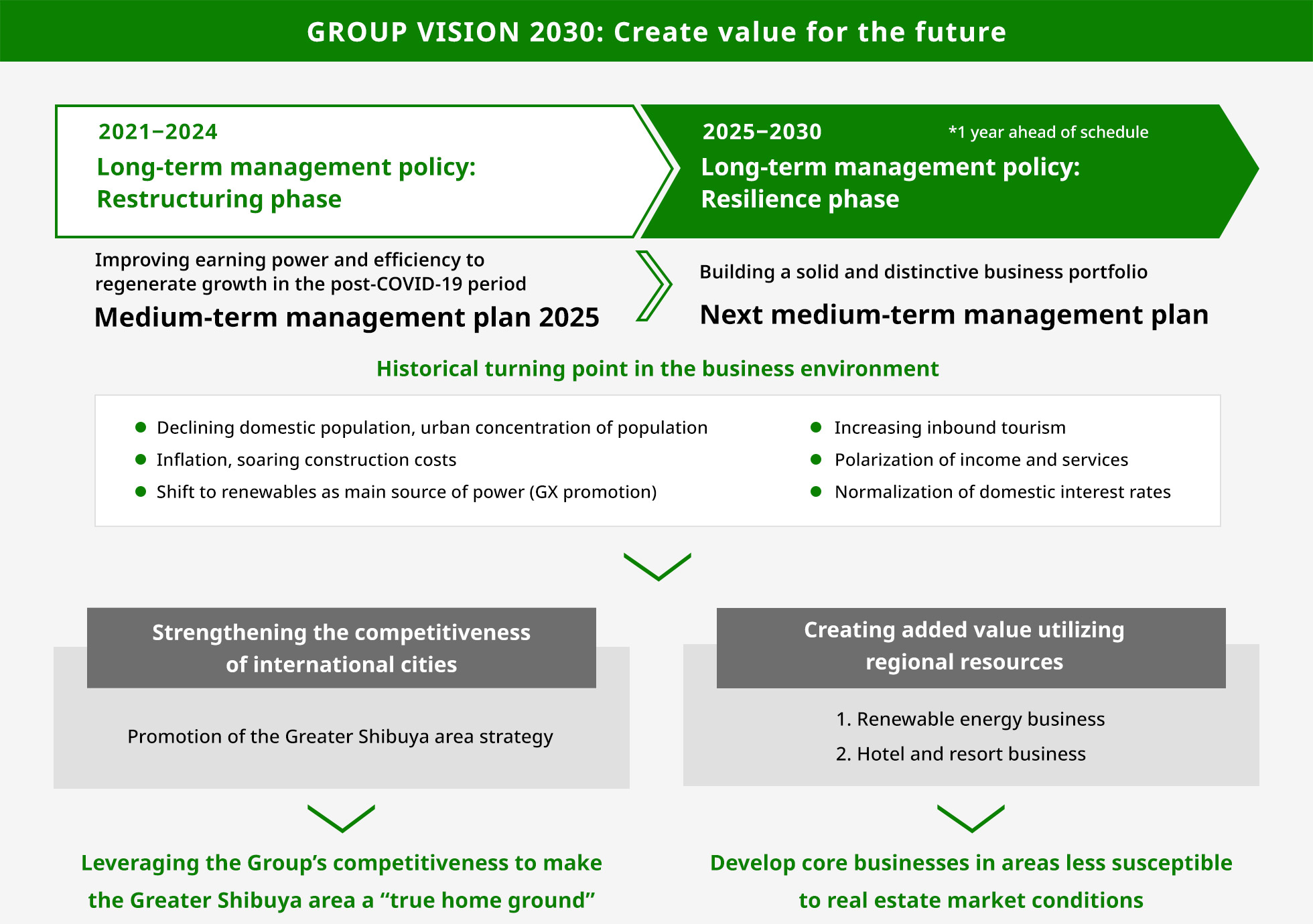

Having assumed the office of president in 2020, three years have now passed since we announced the GROUP VISION 2030 long-term vision and adopted “WE ARE GREEN” as the Group slogan in the midst of the COVID-19 pandemic. The long-term management policy of our 10-year plan is progressing well. During the restructuring phase of the first five years, we embarked on fundamental business restructuring to improve our ROE and EPS, and decisively divested and sold assets and businesses with low profitability and efficiency.

These “surgical” reforms, in which nothing was considered off-limits, have been successful, and in the previous fiscal year, we posted ¥1,103 billion in operating revenue, ¥120.2 billion in operating profit, and ¥68.5 billion in net profit, reaching record highs.

At the same time, we achieved all financial indicators targeted in the medium-term management plan through fiscal 2025 two years ahead of schedule, with ROE improving to 9.6%. In light of these strong results, we will start a new medium-term management plan in the next fiscal year and bring the five-year resilience phase, the second half of our 10-year plan, forward by one year.

But the record profits mentioned above are only in terms of our own Group. The business environment provided a favorable tailwind in the previous fiscal year, and it is a fact that the rest of the industry also did well during this time frame. As such, I refuse to be contented with what we have achieved so far and, maintaining a broader perspective on the environmental changes occurring around us, I will spearhead the Group’s management to take us to further heights.

I am placing particular emphasis on management that is cognizant of capital costs and stock prices. Our stock price exceeded the BPS in March 2024 and our PBR returned to the 1x level. However, due to the unusual stock market in August, our stock price level dropped significantly and is now below 1x again. We recognize that 1x is the minimum line for PBR, and we will work to further improve ROE and PER. We will increase our earning power and efficiency and continue to achieve an ROE above the cost of shareholders’ equity to meet our target of 10% or more in fiscal 2030. In formulating our next mediumterm management plan, as well, we are setting our sights on meeting the expectations of shareholders and investors more than ever before and on raising our PER.

Japan’s transition to an inflationary economy is an opportunity for sales growth

The Japanese economy is now at a historic turning point. The Bank of Japan has ended its policy of negative interest and raised rates for the first time in 17 years. In the real estate business, rising interest rates can be a headwind. Having experienced severe management crises in the past, what I tell everyone in the Group is this: “The better business is going, the better the time to prepare for risks.”

On the other hand, with our Group having completed its business restructuring, I see Japan’s transition to an inflationary economy as an opportunity to make a major shift from securing profits through cost cutting to an environment in which we can generate profits by boosting sales.

We will maximize the Group’s comprehensive strength by leveraging the fortes and broad business wings of each of our ventures. In turn we will deliver value with a competitive advantage and secure the gratitude of our customers. Now is the perfect time to create such a growth cycle and for each of our employees to fully demonstrate the ”challenge-oriented DNA” they share. We will implement ideas that we find interesting, switch to proactive management, boldly take on new challenges, and leverage the entire Group to promote the creation of high added value.

Creating premium value in terms of industry, community, and the environment

In the resilience phase, we will aim to “build a solid and distinctive business foundation.” In addition to existing businesses with industryleading track records like Tokyu Community, which engages in comprehensive property management, and real estate sales brokerage company Tokyu Livable, we will cultivate ventures that can win in specific markets and establish competitive advantages that are difficult for other companies to follow.

Further, through the cross-pollination of these businesses, we will create high added value that no other company can match in terms of such aspects as industry, community, and the environment, and translate their unique qualities into equivalent “premium value.” Viewing economic and industrial policies such as industrial development, urban tourism, regional development, and GX (green transformation) as opportunities, we will work to promote new core businesses by developing the seeds of ventures that will lead to solutions to regional and social issues while aligning with national strategies.

The Group’s wide-ranging business fields can be divided into asset-utilizing and human capital-utilizing ventures in accordance with how their revenue models differ. Similarly, by creating axes for various revenue models, such as urban and rural, and real estate and non-real estate businesses, we will build a strong portfolio that will be less susceptible to being affected by any specific area or market conditions.

In our next medium-term management plan, we will focus on “strengthening the competitiveness of international cities” and “creating added value utilizing regional resources” as key themes for creating premium value. The former is an initiative to enhance the brand power of Tokyo as an international city in the eyes of the world, while the latter will contribute to making Japan a top tourism destination as well as realizing a decarbonized society. I would like to take a more specific look at our strategies for making these themes a reality below.

Key themes in the next medium-term management plan

Strengthening the competitiveness of international citiesConcentrating management resources to make the Greater Shibuya area a true home ground

What makes the Greater Shibuya area so attractive is that it is a place where people gather from all over the world. In addition to the central Shibuya area, the adjoining areas of Ebisu, Daikanyama, Omotesando, and Harajuku each have their own unique cultures, and their diversity attracts many tourists and businesses from across Japan and around the world.

With the creation of wellbeing now a prerequisite for urban development, it is necessary in the real estate industry to work toward strengthening international intermunicipal competitiveness. The Greater Shibuya area already has the concentration of the people, things, money, and information essential for competitiveness, but our Group will be further accelerating the concentration of these elements.

And within this context, our goal is to make Shibuya, already the Group’s home base, a true home ground for us. In collaboration with the Tokyu Group, our Group will concentrate its management resources and provide high added value by linking the value chain in the area, from development to management, operation, and real estate agency. This will increase the value of the area and our presence in Shibuya, making it a place where business opportunities will continue to grow. This is what I envision when I think about Shibuya as a “true home ground.”

To realize this goal, I believe it is important to hone the inherent appeals of Shibuya in the fields of industry development and urban tourism.

Concerning industry development, Shibuya already attracts excellent startup companies. In order to further develop a startup ecosystem in Shibuya that will produce world-class companies going forward, industry-academia collaboration will be an essential ingredient. Academic cities like Boston, for example, have thriving economies because they attract the best and brightest from around the world, especially through their universities. By incorporating partnerships with universities and research institutions in our development of the Greater Shibuya area, we will enhance its international presence.

The Japanese government has drawn up a plan in collaboration with a renowned overseas university to establish a Global Startup Campus as a hub for innovation in Meguro, Tokyo that will encourage the promotion of startups. In our own Group, Tokyu Land Corporation is already engaging in a collaborative program with the Massachusetts Institute of Technology to conduct pilot studies and co-create with startups, and we believe that this experience can also be applied to urban development in Shibuya.

On the other hand, with urban tourism our goal is to realize the concept of “Entertainment City Shibuya,” an exciting city that never sleeps. One of the defining traits of Shibuya is its wide range of attractions, and these are not limited to just its robust nighttime economy. Based on the belief that this characteristic is a product of the interactions of diverse and different people, we are focusing on creating an environment which promotes a cycle of creation, communication, and attraction.

Tokyu Plaza Harajuku “Harakado,” opened in April 2024

Tokyu Plaza Omotesando “Omokado,” located opposite “Harakado”

In both industry development and urban tourism, it is important to create mechanisms that will produce spontaneous and incidental communication and connect the people who gather in Shibuya. I believe that such organic activities foster the culture of an area, including in terms of its history and mood. People, drawn to an area’s culture, further build on and refine it, enhancing its character and attracting yet more people in turn. Creative fields such as design and art are one effective mechanism for promoting this cycle, and they are highly compatible with Shibuya’s innate tendency to embrace new values and inspire creation.

In the current fiscal year, we established the Greater Shibuya Area Strategy Promotion Office. We also strengthened systems across the Group for enhancing the value of the area and expanding business opportunities. As Shibuya’s urban development moves from a physical infrastructure-centered approach to town management aimed at making the area a true home ground for the Group, we will also work to build a creative culture that will serve as a wellspring for making and keeping Shibuya unique.

Creating added value utilizing regional resources ILeveraging natural resources to make renewable energy a core business

Looking to our renewable energy business, with the shift to green energy and the goal of carbon neutrality being global trends as well as cornerstones of Japan’s own energy policy, the market is certain to expand in the future. The Group began engaging in its renewable energy business in 2014. Having focused our efforts on this highly unique business, which is less susceptible to the effects of the domestic real estate market, it currently boasts 113 total projects in Japan and 1.7 GW of power generation capacity (as of the end of June 2024), making it one of the leading businesses of its type in Japan.

Renewable energy projects require steady negotiations and relationship building with the stakeholders of the project site, and this is an area in which we can leverage the knowhow we have cultivated in real estate. In addition, renewable energy projects generally need to be implemented in areas that have specific and highly local characteristics, such as extensive land and strong, consistent winds. Such areas, however, also tend to face common issues like depopulation and shrinking local industry. Our Group is working to help these localities solve such issues while developing projects in tandem with community development.

One particular example is the town of Matsumae, Hokkaido. Here, Tokyu Land Corporation has been operating a wind power plant since 2019. Among its efforts to develop the project in harmony with the local area, the company has concluded a partnership agreement with the municipal government for community development and has begun operating a local microgrid that supplies electricity from its renewable energy generation facilities in the event of a largescale power outage.

In addition, data centers, a market which is expected to expand, are also an area in which the Japanese government is promoting the securing of renewable energy sources. Government-led efforts are underway to attract the location of data centers in Hokkaido, as well, and within this context we will achieve further earnings growth.

The renewable energy business is a business that is locally based, but it also puts one on the same stage as global players. We see its large scale as potential for growth and will continue to develop renewable energy as a core business.

Creating added value utilizing regional resources IICreating next-generation resorts that can solve regional issues

For some 60 years, the Group’s resort business, which began with the development and management of vacation homes, has continued to grow through hotel operation and mixed-use developments. It is now one of our core businesses and has become even more profitable due to increased domestic and external demand post COVID-19. The Japanese government is also promoting tourism, including international tourism, as one economic measure to combat a declining population, and there is no doubt that the opportunities for this business, from resort development to management and operation, will become even greater.

The strengths of the Group’s resort business lie in the knowhow and track record we have cultivated in developing projects in harmony with local communities. By leveraging these strengths to create new value-added experiences and area value, I believe we can develop the resort business as a core business that is more profitable than ever.

Among project locations with large inbound demand like Kyoto and Okinawa, Hokkaido’s Niseko, where we have been working to develop the top international resort in Asia through a public-private partnership, attracts particularly large numbers of people from around the world. In order for Niseko to compete globally in the future, it is important to expand its current, wintertime-focused customer base to include the entire year. By achieving this, we will create a leading example of a next-generation resort that will invite a continuous flow of people from across national borders.

Continuing to take the initiative so people will choose us for our premium environmental value

In our long-term management policy through 2030, we have established environmental management and DX as Group-wide policies. They are essential factors for increasing the Group’s competitiveness and, at the same time, are something which only come into their own when they can be translated into earning power.

In our environmental management, we are actively addressing the key issues of realizing a decarbonized society, creating a recycling-based society, and conserving biodiversity through our respective business activities. By enhancing our brand power and distinctiveness as an environmentally advanced company, and by leveraging our environmental value as one of the Group’s unique strengths, we aim to build a virtuous cycle of business opportunity expansion and revenue acquisition.

Tokyu Land Corporation has switched to using 100% renewable energy at its offices and owned facilities, and in April 2024 became the first company in Japan to be certified as having achieved its RE100 target.*1 By switching all 204 of our sites, including offices, commercial facilities, and hotels, to renewable energy, we have achieved a significant reduction in CO2 emissions, and I believe we are providing environmental value to our customers through the use of our facilities.

In addition, we have received extensive recognition from both inside and outside Japan, such as being selected for inclusion in CDP’s Climate Change A List of companies, the international NGO’s highest ranking, for three consecutive years up to fiscal 2023; and being certified as an Eco-First Company*2 by the Japanese Ministry of the Environment in April 2024, the first domestic real estate company to be so recognized. In both word and deed, we have established a reputation for being an environmentally advanced company. For both the realization of a sustainable society and the long-term growth of the Group, going forward it will be necessary for us to, for example, encourage companies to become more aware of the value of eco-friendly office buildings and desire to actively invest in them. We have continued to take the lead in realizing a society in which environmental value is shifted onto prices. The demand for our environmental initiatives from companies and municipalities seeking to respond to social changes is increasing year by year. This in turn is creating new business opportunities, such as our comprehensive business alliance with the East Japan Railway Company, our establishment of renewable energy funds, and partnerships with local governments such as the cities of Yokohama and Sagamihara for realizing decarbonization.

Also of note is the increasing popularity of ethical consumption, especially among young people. To further encourage the growing awareness of sustainability, we will actively develop environmental education activities aimed at the generations who will shoulder the responsibility for our future.

*1An international initiative committed to 100% renewable energy for the electricity used by businesses by 2050. Excludes facilities to be sold or demolished that are not included in the scope of RE100 and certain joint-venture projects for which Tokyu Land Corporation does not have energy management authority.

Additionally, electricity used excludes electricity from on-site cogeneration as green gas as it is recognized by RE100 does not exist in the domestic Japanese market.

*2A program which provides certification by the Japanese Minister of the Environment to companies that engage in “advanced, unique, and industry-leading business activities” in the environmental field (i.e., those that are environmentally advanced companies in their industries).

Systematically developing DX human capital to accelerate CX improvement

In our promotion of DX, we have made a degree of progress in the first step of reducing the labor involved in business processes, and are now shifting our focus toward improving the customer experience (CX).

Starting in fiscal 2024, we are accelerating our efforts to build new revenue models by maximizing the value of our assets and human capital. And we are achieving this through the establishment of DX priority issues and focus areas for each of our asset-utilizing and human capital-utilizing businesses.

In particular, we view DX in our human capital-utilizing business as key to the Group’s growth because it allows us to leverage our abundant customer contacts, one of the Group’s major strengths. As the so-called “2030 problem,” a result of a declining workforce, becomes a social issue, we will reduce the burden inherent in labor-intensive work through digital means and on the other hand enhance the kind of services that only real human resources can deliver.

In addition, within the Greater Shibuya area, we are working to improve CX by combining attractions from both the digital and real world. Our aim is to create value-added experiences that can only be obtained in Shibuya. We have built urban infrastructure using City OS as well as IOWN in what the world’s first introduction of this high-speed, high-capacity communication technology in the field of community planning is. Additional mechanisms we are implementing include promoting ease of navigation with SHIBUYA MABLs, the real estate industry’s first communication app; utilizing digital twining; engaging in the centralized management of information dissemination media and attracting entertainment content.

And it is on the development of DX human capital that we are focusing in order to further vitalize these efforts. We have designated human capital who connect the business and digital domains as “bridge persons” and are engaging in their systematic development. Since the previous fiscal year, we have been systematizing and disclosing our DX human capital development mechanisms and milestones, as well as implementing training programs that give thought to the resolution of business issues and future community development through the use of digital technology.

The management foundation and organizational climate essential for robust growth

We are building a solid management foundation by strengthening our human capital and financial capital strategies as well as enhancing our corporate governance in order to be a company that will continue to be chosen in the future for its proactive Group management and robust growth.

What we need to create value is the strength each individual employee can contribute. Our Group regards the abilities of its employees as human capital, and is promoting a variety of internal reforms to maximize their potential. We have established three human capital strategies that tie into our management strategies: ”develop people who create value,” “develop organizations with diversity and a sense of unity,” and “enhance motivation to work and foster an employee-friendly work culture,” and we have further formulated KPIs for the measures of each. The operating officers at our Group companies are implementing measures that will help utilize the strengths of our diverse human resources to power the Group’s growth. Examples include establishing KPIs unique to their company to monitor the degree to which Group collaboration has been achieved, and efforts to raise awareness at the management level.

Under our financial capital strategy, we will maintain financial discipline through sound control of assets, liabilities, and equity. At the same time, we will aim for profitable growth that is cognizant of our competitive advantages based on our business portfolio while also maintaining stable returns to shareholders and investors.

With regard to governance, in order to establish a system that is fair, transparent, and contributes to faster decision-making, and to ensure that it functions effectively, we have increased the number and diversity of outside directors, and introduced the use of third-party evaluations to assess effectiveness. Going forward, we will continue working to enhance our corporate value over the medium and long term while fulfilling our responsibility as a member of society to achieve sustainability.

We believe that corporate value is “the sum total of the levels of satisfaction of all of our stakeholders.” The best way to increase stakeholder satisfaction is to have human resources who have “a mission to engage in society,” and an organizational climate that makes the most of its human resources is essential for value creation.

In addition to human capital management, we will continue to work with our stakeholders on human rights considerations and health and productivity management to help build a sustainable society.

Instilling a creative culture in our community planning and in our organization

It is the city that undergoes constant renewal while embracing new people and values that achieves sustainable growth. I feel that our approach to community planning has much in common with the thinking in the field of biology. According to the concept of “dynamic equilibrium” proposed by biologist Shin-Ichi Fukuoka, all living organisms continuously renew themselves at the molecular level in their cells, giving them the resilience to withstand environmental changes and enabling them to evolve. Cities, too, are living organisms, and we could say that community planning is a part of their life cycle.

I believe that management should also follow such laws of nature as the concept of dynamic equilibrium. For both cities and organizations, it takes time to instill a culture. For the diversity-rich Greater Shibuya area, it is important to be ready to accept new people and things, and to further hone the creative culture that will build its future. I am encouraging our members involved in community planning to devise ways to intentionally create incidental communication.

And in the Group, as well, like with our community planning in Shibuya, I want to instill a culture that embraces different values and new things. The word that best sums up our unique organizational climate is “tolerance,” and this word also ties in to our desire for “a future where everyone can be themselves, and shine vigorously,” which is what the gradations of green in the logo for our slogan, “WE ARE GREEN,” represent.

Our employees are best able to contribute to the creation of attractive communities when they can work with enthusiasm while respecting each other’s diverse and unique qualities. I believe that we will experience dramatic growth and development when all of our employees see the needs of society, the Company’s vision, and the realization of their own happiness as parts of a linked whole, and when all of them feel that job and life satisfaction are “premium value” that working for the Group provides.

We will continue to aim to “create value for the future” by endeavoring to reform our organizational climate so that our approximately 30,000 Group employees can share in the progress of the Group, and by ensuring that we follow through with our stated vision and management plans.

2024 Integrated Report for the year ended March 31, 2024