COMPANY INFORMATION

Integrated Report

THE VALUE

CREATION STORY

Integrated Report

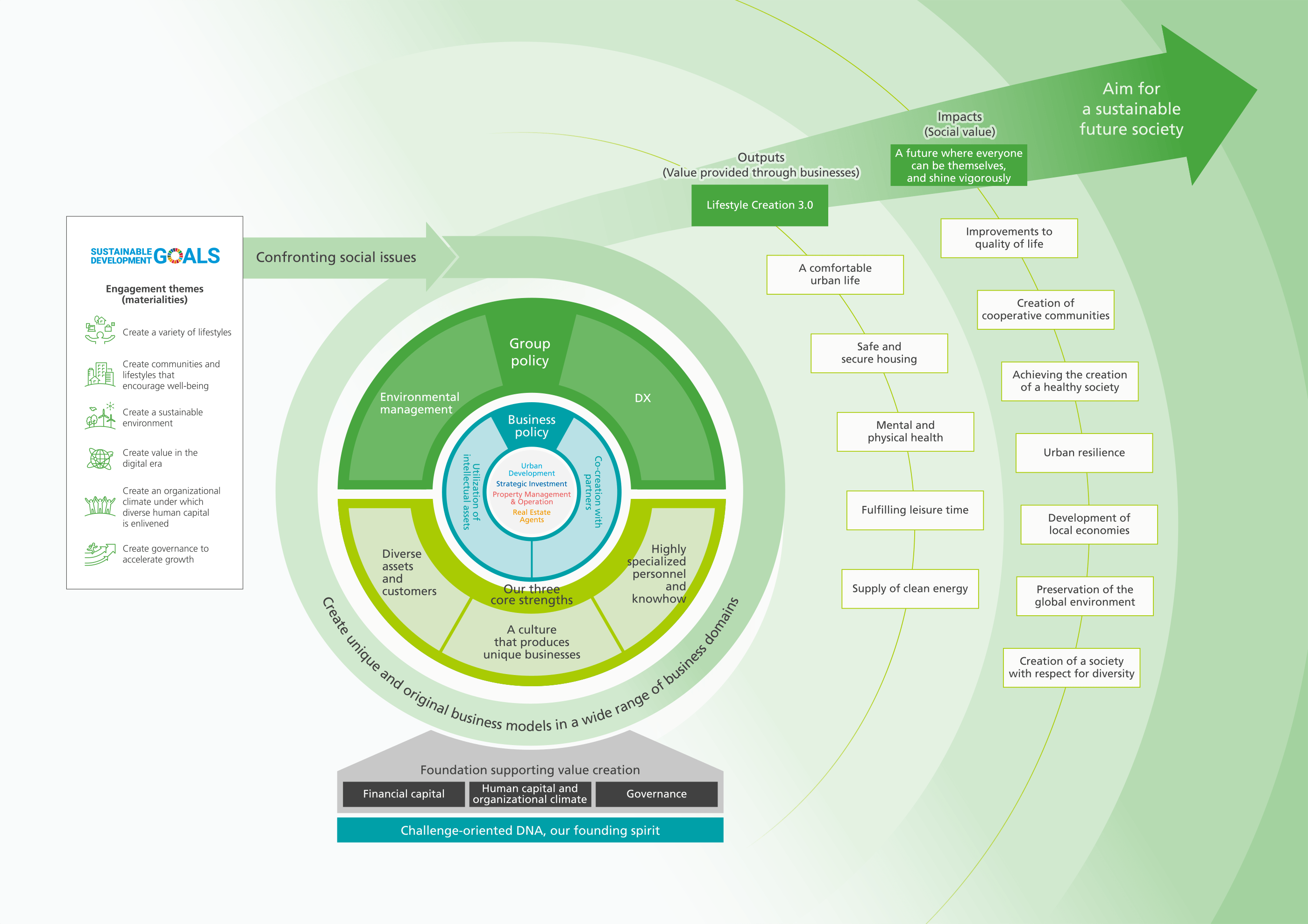

This is the story of our value creation as we aim to be a corporate group that continues to create value. It explains our Group strengths and individuality as we work to solve social issues through our business activities, focusing on concepts found in our long-term vision and themes to work on for value creation (materialities).

2025 Integrated Report for the year ended March 31, 2025

Letter to Our Stakeholders

We will create premium value that addresses societal themes to realize a future where everyone can be themselves and shine with vigor

Hironori Nishikawa

President & CEO, Tokyu Fudosan Holdings Corporation

2025 Integrated Report PDF

A PDF of the entire report (107 pages)

Download to view.

Related Links

Human capital managementin the establishment of our long-term GROUP VISION 2030.

Create value for the future

We resolve social issues through our business activities and aim for sustainable society and growth together with our stakeholders.

We realize a future where everyone can be themselves and shine vigorously through the creation of a variety of appealing lifestyles.

Process for Value Creation

While addressing key social themes, we continue to deliver high added value businesses and services through a business ecosystem that enhances our competitive advantages and enables us to fully demonstrate synergies. This includes synergies between the broad customer/market contact points that are the source of the Group’s strength and which generate huge volumes of information through a wide variety of customer interactions, and our unique business creation ability through which we generate difficult to imitate businesses that combine diverse elements.

You can scroll this table sideways

Themes of Our Efforts to Create Value (Materialities)

To realize its ideal vision, the Group is engaged in efforts focused around six themes (materialities) through its business activities.

By implementing strategies in line with each theme, we will contribute to the creation of a sustainable society.

-

Create a variety

of lifestylesLifestyle

We will help people to enjoy lives that are both physically and mentally vibrant by promoting the Lifestyle Creation 3.0, a combination of home, work and play styles.

-

Create communities and lifestyles

that encourage well-beingLiveable City

We will realize a society where everyone can feel happy by building secure, safe and comfortable life infrastructure and creating communities where people help each other.

-

Create a sustainable

environmentEnvironment

As an environmentally advanced company, we will create a carbon-free and recycle-based society by addressing global issues such as climate change.

-

Create value

in the digital eraDX

We will transform our business models by utilizing digital technologies to create new experience value for customers.

-

Create an organizational climate under

which diverse human capital is enlivened.Human Capital

We will continue to create innovation through an organizational climate that respects human rights and under which diverse human capital can exercise their abilities.

-

Create governance

to accelerate growthGovernance

As a group trusted by all stakeholders, we will aim to enhance our corporate value sustainably by increasing management transparency and fairness.

Value Provided Through the Materialities

The Group has organized business opportunities and risks and established KPIs for each materiality toward the achievement of its ideal vision for 2030.

In this way, we aim to increase outputs and impacts on society and contribute to achieving the SDG goals.

Financial Capital Strategy

Message from the Executive Officer

We aim to build a strong and unique business portfolio, enhance efficiency, growth potential,

and resilience to market fluctuations, and increase corporate value.

Outside Director Discussion

Building on the achievements of the previous medium-term management

plan to enter the resilience phase

The new medium-term management plan 2030 has been released. The outside directors had a free and open exchange of opinions about what kind of discussions were held while formulating the plan, what commitments they made during the formulation process, their evaluation of the plan, and what achievements and issues they expect to emerge in the medium to long term.